-

Cale

May 17, 2021Placeholder post, more thoughts later this week. Today, however...it's Tax Day.

Cale

May 17, 2021Placeholder post, more thoughts later this week. Today, however...it's Tax Day.

In the meantime, from the WSJ:

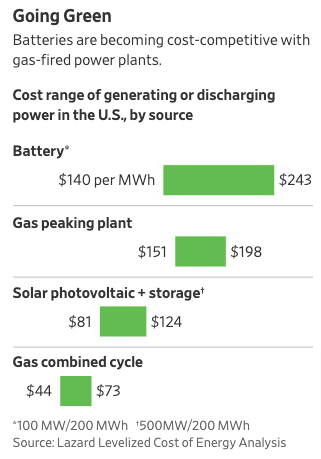

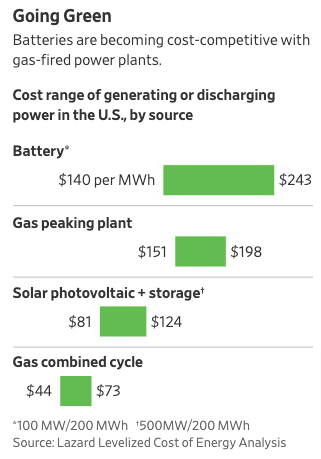

Natural Gas, America’s No. 1 Power Source, Already Has a New Challenger: Batteries

That shift of gas away from baseload demand is going to take a loooong time, though...not to mention that some coal use is going to be pretty persistent, too. And don't think it should be a surprise here to note my own conviction that U.S. nat gas exports will mean healthy long-term growth for most E&Ps in any case...

Gotta jump for now.

Grit those teeth and write those checks, Americans! -

Cale

May 10, 2021Through peak earnings season, but another call this morning. More on the public boards after that. In the meantime, most notable macro news in the sector over the weekend...

Cale

May 10, 2021Through peak earnings season, but another call this morning. More on the public boards after that. In the meantime, most notable macro news in the sector over the weekend...

Oil gains after cyberattack forces shutdown of U.S. fuel pipelines -

Cale

May 3, 2021WTI flat, nat gas down 0.3%, broader market futures green.

Cale

May 3, 2021WTI flat, nat gas down 0.3%, broader market futures green.

Fairly quiet in the oil market over the weekend, though we did see a little noise between both sides on the U.S./Iran JCPOA negotiations. Nothing material of note.

This week is also peak Q1 earnings season for Tarpon companies - three calls on Tuesday, one on Wednesday, four on Thursday. Call notes to follow on private boards. Expecting more positive surprises. Public posts will be light again this week between our group and a handful of watchlist companies reporting....

Monday assorted links

1. Warren Buffett: 'Chevron's not an evil company in the least'

People that are on the extremes of both sides are a little nuts.

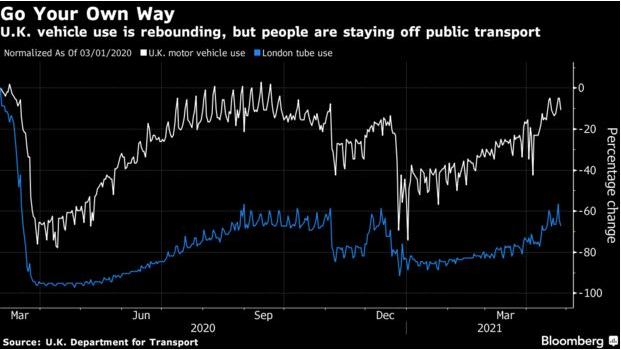

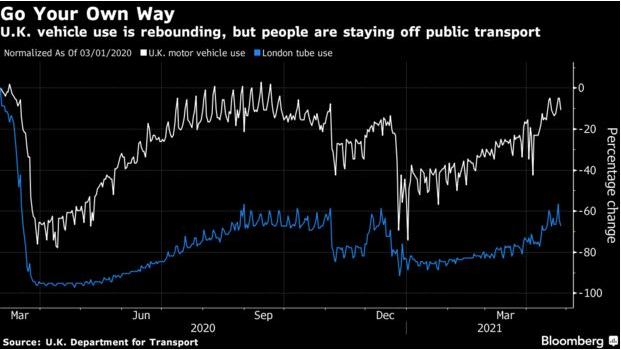

2. BBG: Cars Make a Covid Comeback, and That Means Burning More Oil

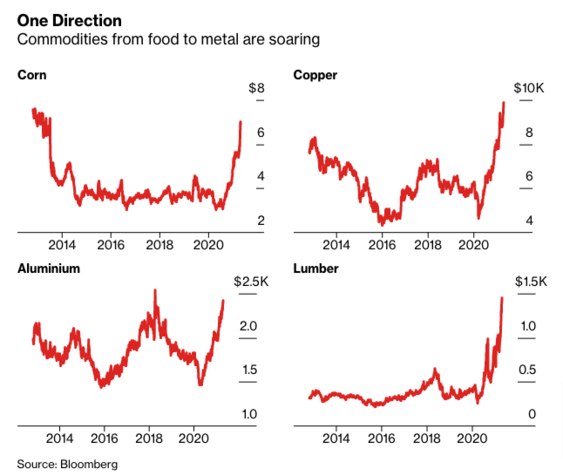

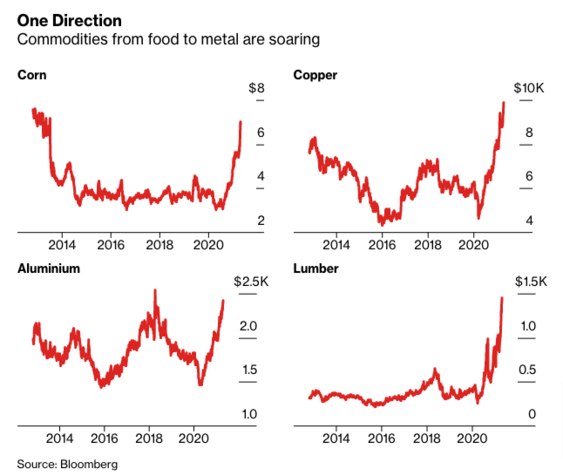

3. BBG: The Price of the Stuff That Makes Everything Is Surging

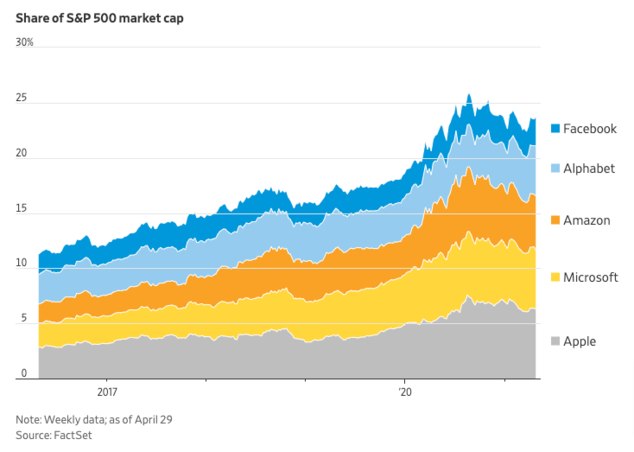

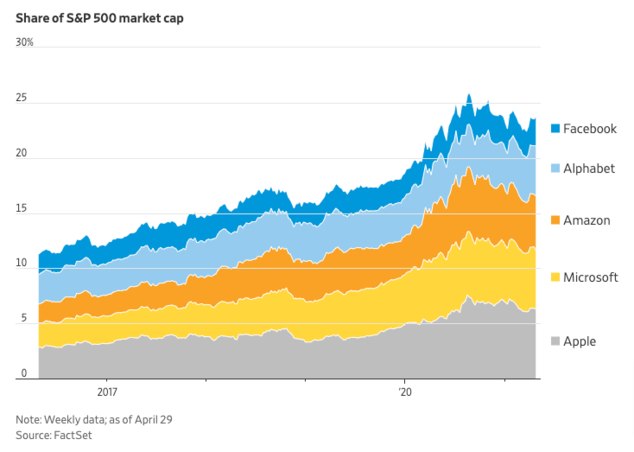

4. WSJ: Five Tech Giants Just Keep Growing

The stock market gives a glimpse of just how enormous these companies have become in this extraordinary period: Combined market value for the five Big Tech companies is now over $8 trillion, accounting for nearly a quarter of the total value of the companies in the S&P 500. That is nearly double the percentage five years ago.

Emphasis mine there. Here's a snap:

5. Axios: To combat climate change, electric cars have to be cheaper

Let’s be real. We’re not even close to meeting our goals. We’ve got to get to a new set of consumers.

6. Kemp on Reuters: Inflation-tolerant Fed will boost commodity prices

The U.S. Federal Reserve has signalled it will tolerate faster inflation for a time to cement the post-pandemic recovery and boost employment, but the side effect is likely to be a faster rise in commodity prices.

The central bank appears anxious to avoid a repeat of the slow expansion and job gains that followed the financial crisis of 2008 by adopting a more aggressive approach to stimulating the recovery.

7. Business Insider: 1 in 5 electric vehicle owners in California switched back to gas because charging their cars is a hassle, new research shows

...according to a new study published in the journal Nature Energy by University of California Davis researchers Scott Hardman and Gil Tal that surveyed Californians who purchased an electric vehicle between 2012 and 2018.

Roughly one in five plug-in electric vehicle (PEV) owners switched back to owning gas-powered cars, in large part because charging the batteries was a pain in the… trunk, the researchers found.

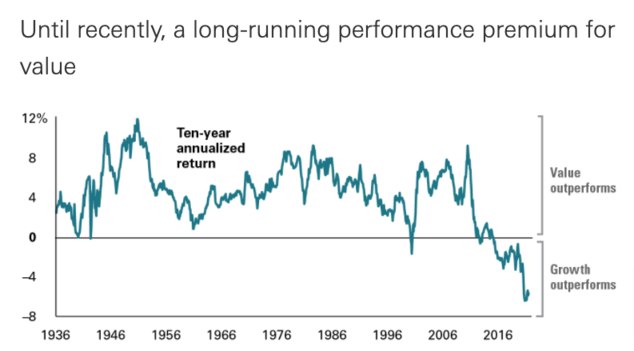

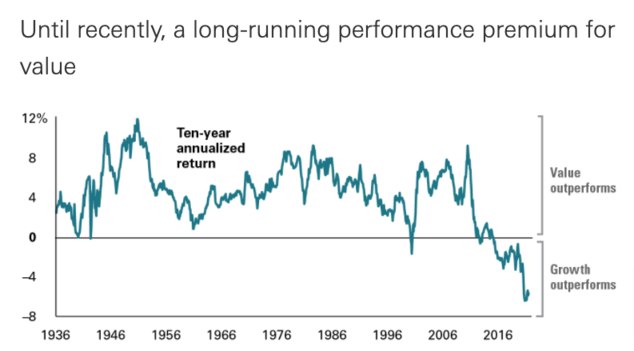

8. Vanguard: Why U.S. value stocks are poised to outperform growth

And a couple of other links from the crowd, sent in via email over the weekend:

Bill Maher on Bitcoin - and though I am not endorsing the high snark, hyberbole, nor whatever this gentleman's politics may be, I confess I did chuckle a little at the line "...cryptocurrency is like Tinkerbell's light - its power source is based solely on enough children believing in it."

Tough weekend for bitcoin sentiment between that clip and Charlie Munger's comments on Saturday ("disgusting and contrary to the interests of civilization" as per here). Probably trading 20% higher, though, as I type, I dunno.

And @Adrian heads-up on this article on unowned ReconAfrica on CNN, too: A Canadian oil firm thinks it has struck big. Some fear it could ravage a climate change hotspot.

Thought this quote from there was pretty on-the-nose:

Someone who is sitting in Norway and has a very good quality of life because of the oil that was found in the North Sea is now telling the world that it should run on renewables. If you are sitting in Africa, your incentives are very different.

Back in a while.

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

April 26, 2021Assorted Monday links

Cale

April 26, 2021Assorted Monday links

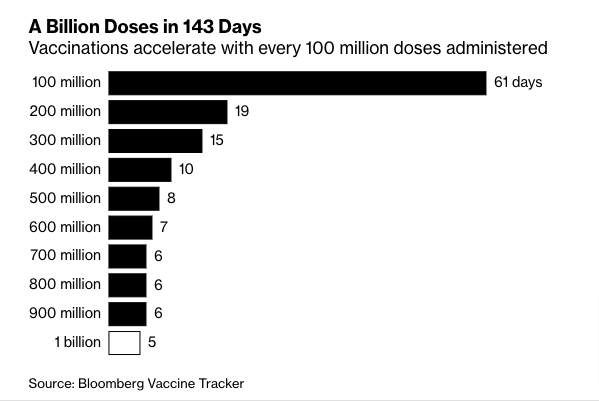

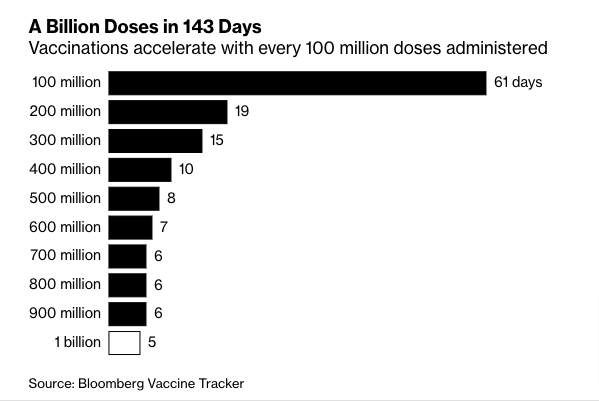

1. BBG: The First Billion Doses

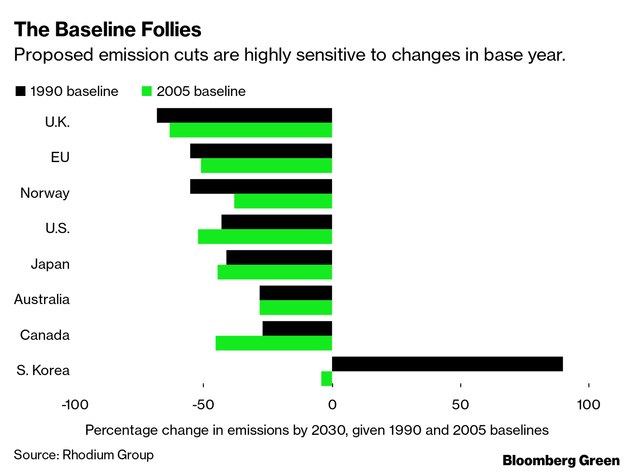

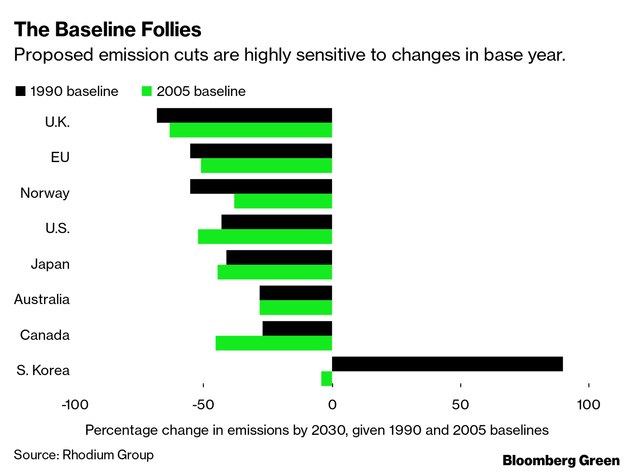

2. BBG: Why It’s So Hard to Compare Countries’ Climate Goals

3. WSJ: Global Emissions Goals Come With Big Cost and Political Hurdles

What do you do about cement? What do you do about steel production? What do you do about agriculture? What do you do about aviation and shipping?” he said. “There’s a tendency when you study radical technological change to overestimate what’s possible in the near term.

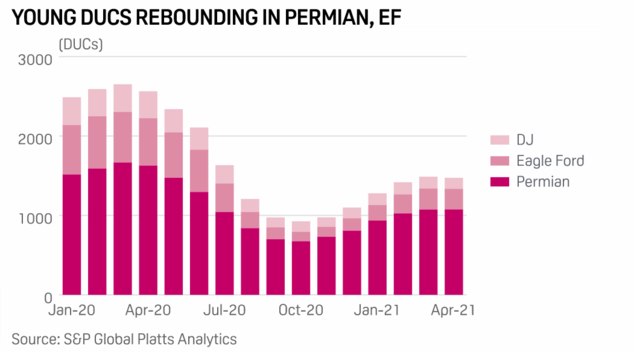

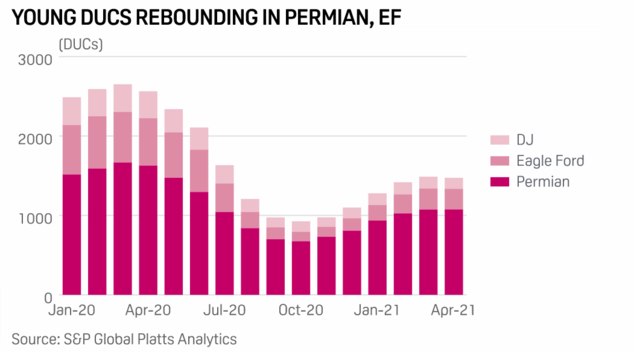

4. Platts: Number of wells drilled in Permian, Eagle Ford make substantial recovery

5. Reuters: Frustrated Canada presses White House to keep Great Lakes oil pipeline open

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

April 19, 2021Assorted Monday links

Cale

April 19, 2021Assorted Monday links

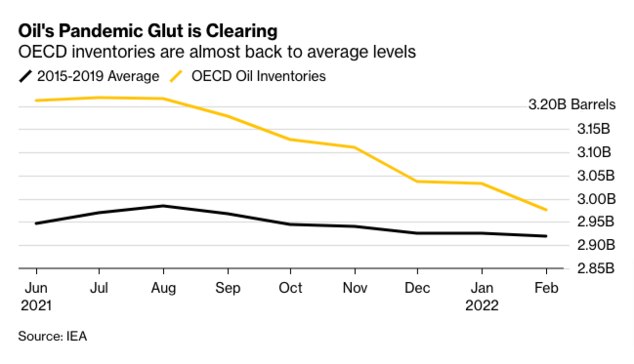

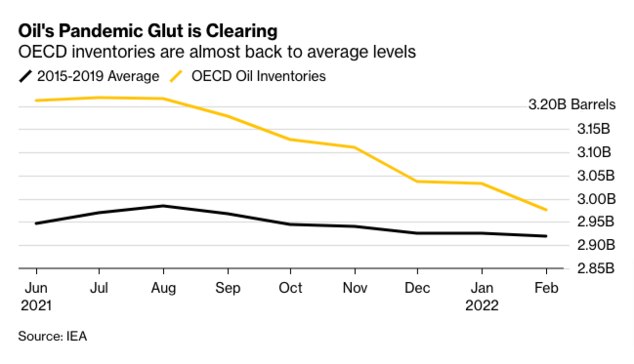

1. BBG: Historic Oil Glut Amassed During the Pandemic Has Almost Gone

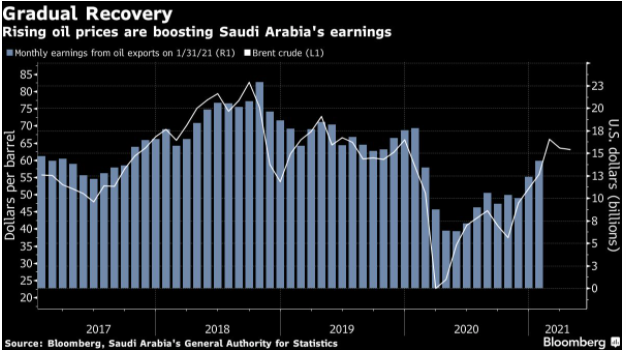

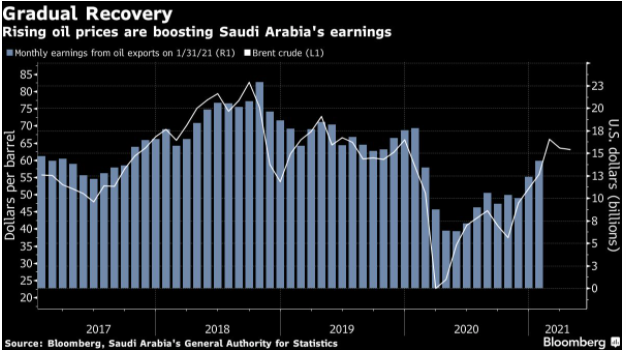

2. BBG: Saudi Crown Prince’s Latest Economic Plan Comes With Big Risks

3. Why has nuclear power been a flop?

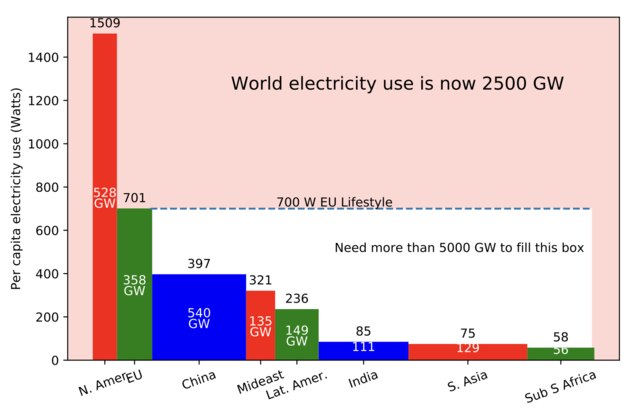

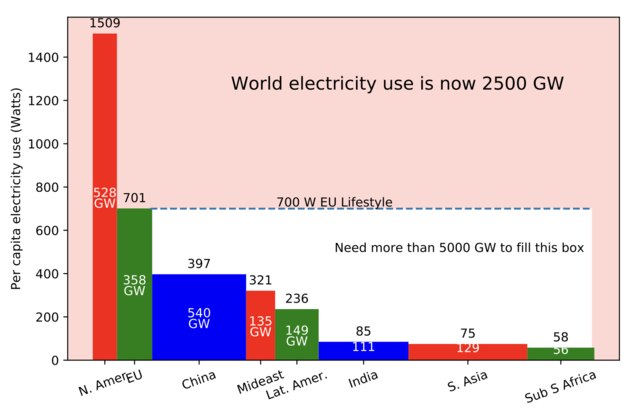

There is a great conflict between two of the most pressing problems of our time: poverty and climate change. To avoid global warming, the world needs to massively reduce CO2 emissions. But to end poverty, the world needs massive amounts of energy. In developing economies, every kWh of energy consumed is worth roughly $5 of GDP.

How much energy do we need? Just to give everyone in the world the per-capita energy consumption of Europe (which is only half that of the US), we would need to more than triple world energy production, increasing our current 2.3 TW by over 5 additional TW:

4. Submitted over the weekend...

WSJ: BP Wants to Stop Burning Off Gas in America’s Top Oil Field

The idea you can drill an oil well with no destination for the gas has to stop.

Perhaps one of the rare real benefits of the ESG movement - pressuring the industry to address one of its more egregious sins. Positive read-thru in there for U.S. LNG exporters as well.

5. IHS Markit - Biden’s American Jobs Plan: An opening bid to reshape the US power system

Ultimately, the American Jobs Plan is an opening bid in what will surely be a dynamic and contentious process—and it signals the Biden Administration is looking to implement the rapid clean energy transition it campaigned on. If enacted in full, the plan would represent the most aggressive federal climate response to date—but substantial revisions can be expected.

6. BBG: China Says It Has No Desire to Replace Dollar With Digital Yuan

China sought to allay fears it wants to topple the dollar as the world’s main reserve currency as Beijing makes bigger strides in creating its own digital yuan.

People’s Bank of China Deputy Governor Li Bo said the goal for internationalizing its currency is not to replace the dollar, and the efforts to create a digital yuan are aimed at domestic use.

“For the internationalization of the renminbi, we have said many times that it’s a natural process, and our goal is not to replace the U.S. dollar or other international currencies,” Li said on a panel at the Boao forum Sunday. “I think our goal is to allow the market to choose, to facilitate international trade and investment.”

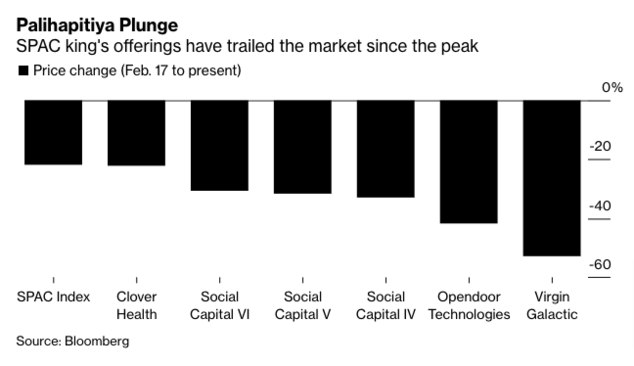

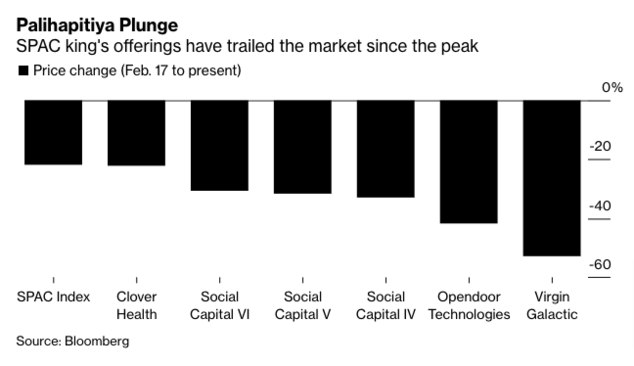

7. BBG: SPAC Wipeout Is Punishing Followers of Chamath Palihapitiya

Days before the rout began, Palihapitiya, a 44-year-old venture capitalist with a flair for self-promotion, proclaimed he was poised to be the Warren Buffett of his generation. “Nobody’s going to listen to Buffett.”

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services.

Active Discussions

-

Such an Exciting and Opportunity-Filled Time to be an Infrastructure Investor JRo,

-

United Rentals Acquiring H&E Equipment Services in ALL CASH Deal JRo,

-

"Generational" Growth Opportunity for Infrastructure According to Goldman Sachs JRo,

-

“$2 trillion in hyperscaler cloud capex could be deployed in the next five years” JRo,

-

Excellent letter from Samantha McLemore (Bill Miller’s #2 for 20 years) Cale,

- Terms of Service

- Useful Hints and Tips

- Sign In

- © 2025 Spoke Fund® Boards