-

Cale

April 14, 2021WTI up 1.3% to > $60 on a positive monthly update from the IEA. Nat gas up 1%.

Cale

April 14, 2021WTI up 1.3% to > $60 on a positive monthly update from the IEA. Nat gas up 1%.

IEA increased '21 oil demand forecast by 0.23 mm bopd on a stronger global economic outlook.

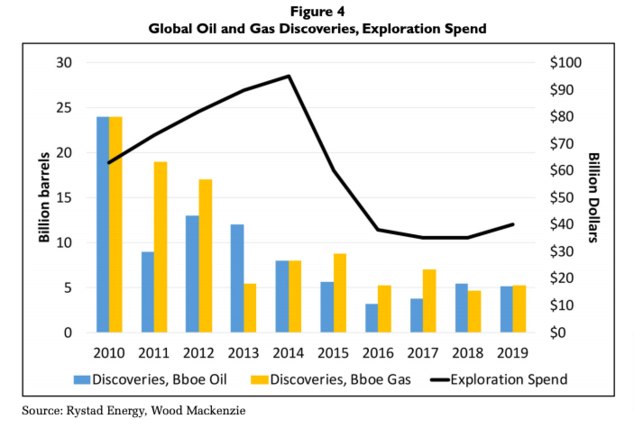

Also sees increasing need for 2.0 mm bopd in supply later this year to meet demand recovery...beyond what has already been announced by OPEC+. Summary of the report here.

So, IEA little more bullish than that OPEC Monthly yesterday - and that was on the positive side of neutral. Demand forecast bumped up, economic forecast bumped up, no material changes in non-OPEC supply, and continued reduction in global oil stocks. Reuters summary of that here.

Meanwhile, geopolitical tensions increasing notably of late between Russia/Ukraine and Israel/Iran. Would add those to the lower-boil but still of note China/Taiwan conflict, too. Overnight, Iran declared its move to begin enriching 60% uranium and installing a thousand new centrifuges as a response to the "sabotage" at its Natanz facility over the weekend. There is a plot hole in that narrative, unless it involved some time travel I missed, but in any case, the Israel-Iran shadow war appears to be heating up...just as those new JCPOA-related talks begin.

Assorted Wednesday links

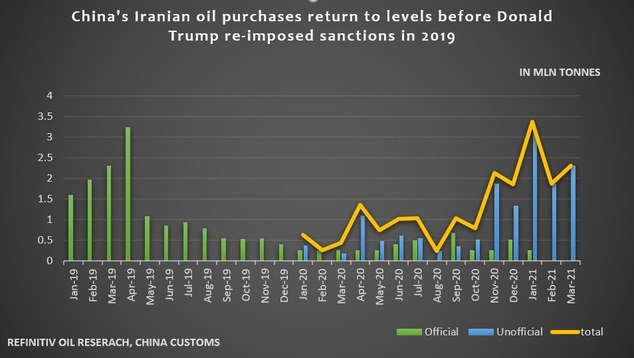

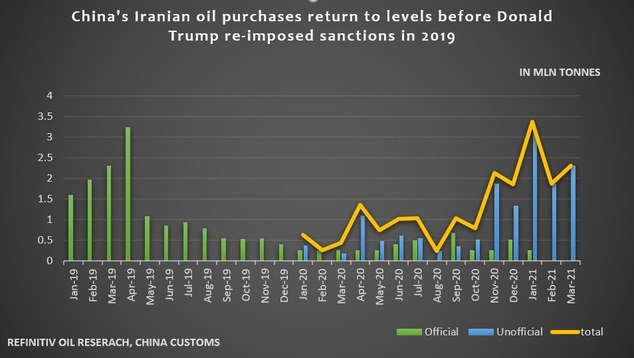

1. Reuters: China's Iranian oil buying spree crushes demand for Brazil, Angola crude

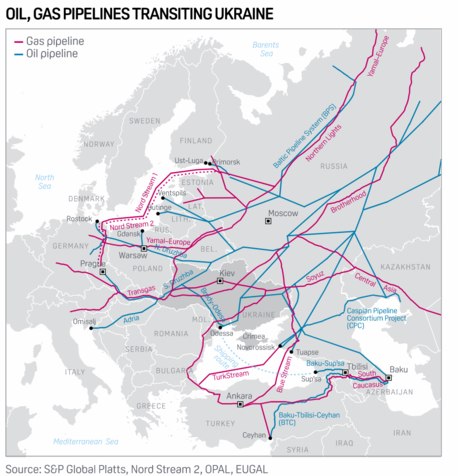

2. Reuters: Russian escalation in Ukraine yet to faze commodity markets

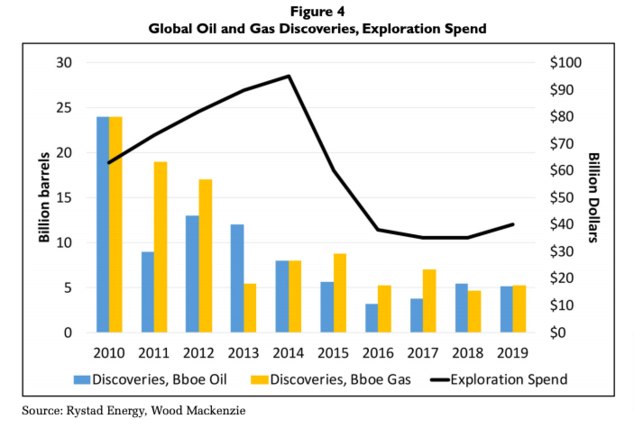

3. EPRINC: With Global Oil Demand on the Rebound, What About Supply?

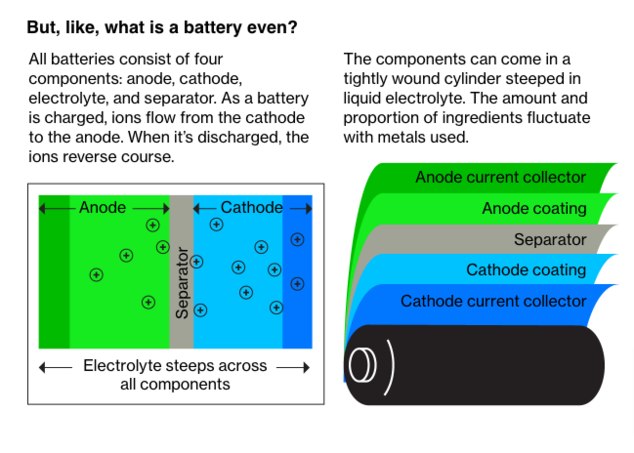

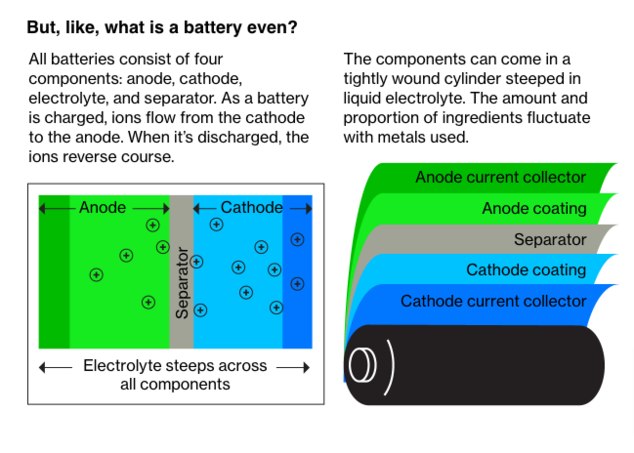

4. Bloomberg profile of battery tech company $QS (unowned) here: Inside QuantumScape

Had no idea that Exxon had any role there in the development of lithium. Interesting.

5. Turns out now is an excellent time to sell an old truck:

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

April 13, 2021From my latest letter to investors, which can be downloaded here.

Cale

April 13, 2021From my latest letter to investors, which can be downloaded here.

Thoughts on EVs and Oil Demand

The most common question I’ve gotten the last few months has been about the impact of the new U.S. Administration on the oil and gas sector.

I addressed that in more detail during the annual meeting videos (first is here, second is here), but as a quick rehash: anything that restricts or hinders the production of oil and/or natural gas in the U.S. will, by definition, lead to higher prices in those commodities – and for the assets that produce them, too. That paradox has no doubt played a role in our recent returns, too.

The second most common question I get is with regards to EVs or electric vehicles - specifically on their impact on our companies – or, more broadly, the demand for oil.

First, know that I come to neither praise nor bury EVs. Teslas are amazing vehicles. The stock, however, appears extremely overvalued to me.

I also feel pretty strongly that we are witnessing a speculative bubble when it comes to the stocks of many EV and renewables companies. But that’s an issue of valuation, not politics. I am keenly interested in the former and have zero interest in the latter.

I suppose my own bias is that I look forward to one day driving around the Florida Keys in an electric pick-up truck.

But (a) that day is going to be a long way off, and (b) that’s probably just my irrational fondness for pick-ups.

Shoot, I’m 6’3”. Unless you’re a chiropractor, get outta here with that coupe.

Also, the main reason I look forward to one day having an electric truck is that Ludicrous Mode will help me put all these tourists in my rearview a whole lot faster.

Hahaha kidding. Tourists are always welcome in Islamorada - of course!

Except for the ones that feed seagulls.

Anyway, I say all that to say this:

EVs are being over-hyped. They’re not likely to significantly disrupt oil demand for at least another decade - and probably even further out. And though their growth rates sound impressive, those numbers you often see quoted are off of a tiny base.

For instance: it is true that in 2019, 40% more electric vehicles were sold than in the year prior.

But in raw numbers, that was 2.1 million EVs. Which should be compared to the 80.7 million ICE (internal combustion engine) vehicles sold that same year.

And while that 40% jump in EV sale meant there were then 7.2 million total EVs on the road, they were also sharing those roads with 900 million ICE automobiles already driving around.

And it’s estimated that those electric vehicles driving avoided the consumption of just 600,000 barrels of oil products per day in 2019.

Versus the 101 million barrels of oil used every day that year – the highest in history.

Which means that in 2019, EVs displaced just 0.6% of total oil demand.

EVs aren’t just competing against today’s ICE cars, either, though. They will be competing against tomorrow’s ICE cars, too. And it is going to be a long, brutal fight.

The World Bank believes approximately two billion people in emerging market economies will likely be lifted out of poverty by 2035. That coming increase in prosperity and living standards - in some of the most populous countries on the planet - is only going to drive further increases in the global demand for oil.

For instance, S&P Global Platts Analytics sees global oil demand peaking in 2040 at around 115 million barrels of oil per day (bopd). That’s 15 million barrels a day higher than the historical peak in 2019. And in spite of the rapid growth of EVs over that same period of time.

BP’s Energy Outlook 2035 forecasts growth in electric cars over the next two decades from 1.2 million vehicles to around 70 million in 2035 – nearly a 60-fold increase. Which sounds bullish for EVs and bearish for oil…until you realize that - due to those increased living standards in poor countries - the total number of autos with internal combustion engines around the globe is expected to double over that same time.

In which case, we would see another 900 million ICE cars on the world’s roads by then, in addition to the current global fleet - of the same size.

And while fuel efficiency standards will no doubt get stricter over time, unless those 70 million EVs can somehow completely displace the oil needed every day to fuel 1.8 billion ICE cars…the total oil demanded by automobiles every day will still increase. Even if the number of EVs grows 60x between now and then.

I will leave it to you to determine how realistic that may be.

The adoption rate of EVs will depend ultimately on consumer demand – but from all consumers, all around the world - not just high income earners in the West currently buying them in small quantities. That demand will in turn be dependent on affordability, charging times, charger locations, and perhaps most importantly, advances in battery technology – as well as avoiding some extremely challenging bottlenecks in the supply of commodities like lithium and cobalt that are critical in the supply chains for those batteries.

My point is this:

The path for EVs to reach critical mass around the globe is going to be more difficult – and take much longer - than the headlines might lead you to believe. Even with significant shifts in government policies.

And as relates to the Tarpon Folio, we don’t need to worry about EVs materially impacting oil demand anytime soon. It’s unlikely to happen until well after the next peak in this oil cycle.

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

April 5, 2021Quick note for site visitors: public posts will be sparse this week. In the cave working on a quarterly update to investors. If you're not on the email list for my letters but would like to be, please sign up here.

Cale

April 5, 2021Quick note for site visitors: public posts will be sparse this week. In the cave working on a quarterly update to investors. If you're not on the email list for my letters but would like to be, please sign up here.

Lotta eyes in energy on the news that first popped up over the holiday: the U.S. and Iran will indirectly enter informal talks on April 6th with an aim of moving back towards the JCPOA. Which would mean a resumption of Iranian oil production...eventually. Stay tuned.

WTI down to $59-high this morning, which is less than I thought the knee-jerk reaction by traders might be on those JCPOA headlines. Yet another sign the oil market is considerably healthier than this same time a year ago. And perhaps that move is also being somewhat tempered by expectations for a big draw in U.S. crude inventories in this Wednesday's EIA weekly report.

Monday assorted links

1. Platts: Iran to seek removal of sanctions during Vienna talks

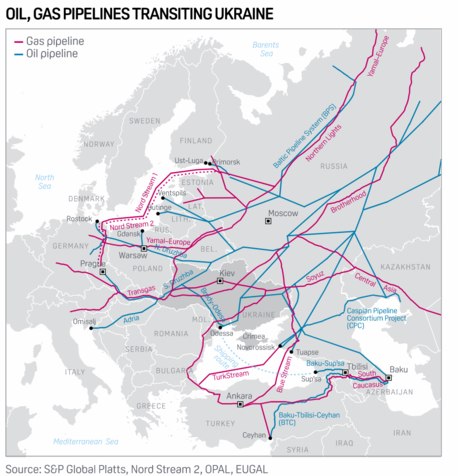

2. Politico: German official calls for construction ‘moratorium’ on Nord Stream 2 to repair US relations

3. FT: Biden faces backlash from US states to his clean energy agenda

Republican-led state capitols are considering bills that would punch holes in President Joe Biden’s green revamp of the US electricity system by promoting fossil fuels or piling costs on to renewable energy.

The proposed legislation reverses a dynamic that played out over the past four years, when lawmakers in states controlled by Democrats moved to counteract Donald Trump’s climate rollbacks. One analyst described a “Biden backlash”.

Legislators have sharpened their focus since a winter storm caused blackouts in Texas and Midwestern states in February. Despite a varied set of causes, some have invoked the crisis to propose new constraints on solar and wind power.

If enacted, the bills would cloud Biden’s objective of driving down carbon emissions from the electricity sector, one that he intends to bolster with a $2tn federal infrastructure plan announced last week.

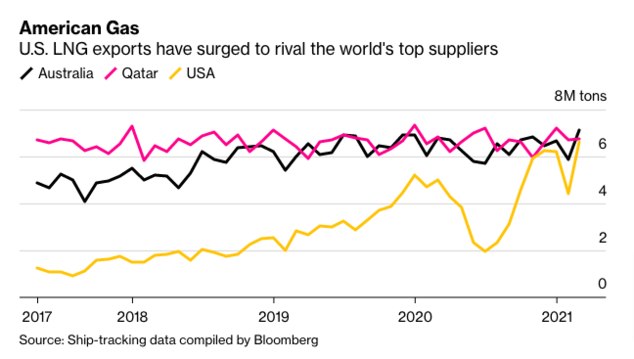

4. BBG: Global LNG Demand Jumps the Most Since Pandemic Dashed Trade

5. From yet another Substack: Bidenomics, explained. Short version:

- Cash benefits

- Health care jobs

- Public investment

Also would note we may see some headlines out of the energy companies presenting at the Enercom conference in Dallas this week.

All for now on this public post. More company news this week for IIM investors on the private boards.

Otherwise, consider this an open thread. Thx. -

Cale

March 29, 2021The ship appears to be unstuck.

Cale

March 29, 2021The ship appears to be unstuck.

Ah, I'm really gonna miss those memes.

Next OPEC+ meeting on Thursday. Appears Russia supports OPEC+ oil output rollover to May...while angling for another bump up in volumes for itself, natch.

WTI has reversed earlier losses this morning and is now up 0.4%, and nat gas is up 0.7%. POTUS has a speech in Pittsburgh on Wednesday that should also provide more clarity on what he wants in the wider infrastructure proposal. Expected to be well north of a trillion dollars and will likely have some significant clean energy provisions.

Meanwhile, Street is a bit obsessed this morning with the latest hedge fund to blow itself up. Hard to believe how big some of those positions were. And standby for some prime brokerage "risk reduction" trades in some of those same tech stocks, you would think.

Monday assorted links

1. WSJ: New Mideast Crude Contract May Test OPEC’s Grip on Oil

Abu Dhabi plans to relinquish control over prices of Murban to investors and traders, a major step in efforts to fortify its position in the international oil market. The goal is to make Murban more attractive to refiners in Asia, where oil producers are battling for customers as Western governments seek to phase out fossil fuels.

By allowing crude to trade more freely, the emirate could ultimately undermine the sway of the Organization of the Petroleum Exporting Countries over prices. The changes that Abu Dhabi is making will erode the influence of cartel leader Saudi Arabia over time, Philip Verleger, an energy economist and president of PKVerleger LLC, said.

“Oil will flow more freely around the world where it is needed, and that will make it more difficult for OPEC to maintain control on prices,” Mr. Verleger said.

2. WSJ: Iran, China Sign Economic, Security Agreement, Challenging U.S. Pressure

...In return for investments, China would receive steady supplies of Iranian oil, Iran’s semiofficial Tasnim news agency said Saturday, adding that the two countries also agreed to establish an Iranian-Chinese bank. Such a bank could help Tehran evade U.S. sanctions that have effectively barred it from global banking systems.

“This cooperation is a basis for Iran and China to participate in major projects and infrastructure development,” including Beijing’s Belt and Road initiative, said Iranian President Hassan Rouhani on Friday ahead of the signing, referring to China’s vast global investment and development strategy.

The deal deepens cooperation between Tehran and Beijing at a time when China is seeking more influence in the Middle East and when Iran is looking for ways to support an economy that has been battered by U.S. sanctions.

3. American Airlines with a positive read-thru for jet fuel demand:

As of March 26, the Company’s seven day moving average of its net bookings is approximately 90% of the level experienced in 2019, with a domestic load factor of approximately 80% during that same period. The Company presently expects this strength in bookings to continue through the end of the first quarter and into the second quarter.

4. How mRNA Technology Could Change the World

5. Miami Heat arena to be renamed after cryptocurrency exchange FTX. Anyone else have a flashback to PSINet Stadium?

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

March 22, 2021Monday assorted links

Cale

March 22, 2021Monday assorted links

1. Despite some turbulence, global oil demand is on the route to recovery

The part of people’s lives that has been missing has been going places and seeing scenery other than the inside of their house. They will want to get out, and that means travel, which means oil demand.

2. India forecasts oil consumption to double, add 4.3 mmb/d to 8.7 mmb/d in 2030

Oil demand is expected to grow from 4.4 to 8.7 million barrels per day ie 435 million tonnes per annum. Part of this requirement will also come from the production of petrochemicals as newer refineries are built with higher integration with petrochemicals.

3. Career staff to resume U.S. federal drilling permit approvals - Interior Dept

The Biden administration on Monday said U.S. Bureau of Land Management (BLM) office staff would resume processing oil and gas drilling permits later this week following a two-month period when those approvals were limited to senior officials in Washington.

Interior Department will launch a formal review of the program on March 25.

4. Khamenei says U.S. promises have no credibility for Iran

The United States and the other Western powers that signed up to the 2015 deal appear to be at odds with Tehran over which side should return to the accord first, making it unlikely that U.S. sanctions which have crippled Iran’s economy can be quickly removed.

Look for the new U.S. Administration to clamp down more on those Iranian barrels China appears to be importing.

5. China Opened Up Its Pipelines and LNG Upstarts Are Blooming

China’s smaller liquefied natural gas buyers are seizing on reforms that’ve opened access to import infrastructure to boost competition, issuing a spate of tenders for the fuel over the past month.

The second-tier gas firms, including Guangdong Energy Group Co. and Shenzhen Energy Group Co., are forecast to continue to seek more cargoes with spot LNG prices low, adding a new source of demand for global exporters, according to energy consultant FGE.

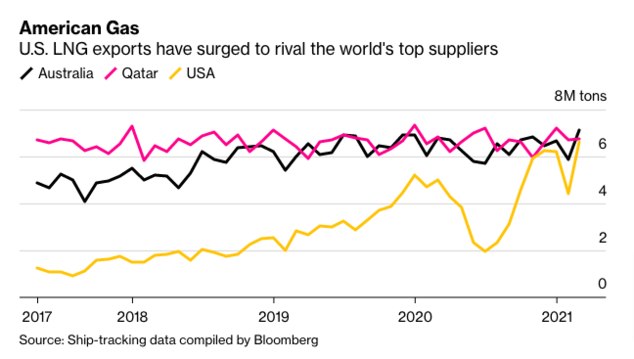

6. U.S. LNG exports on track to hit record high in March

7. Once more, on the importance of superspreading events:

Empirical observation throughout the SARS-CoV-2 pandemic has shown the outsized role of superspreading events in the propagation of SARS-CoV-2, wherein the average infected person does not transmit the virus. Our results suggest the same dynamics likely influenced the initial establishment of SARS-CoV-2 in humans, as only 29.7% of simulated epidemics from the primary analysis went on to establish self-sustaining epidemics. The remaining 70.3% of epidemics went extinct…Furthermore, the large and highly connected contact networks characterizing urban areas seem critical to the establishment of SARS-CoV-2. When we simulated epidemics where the number of connections was reduced by 50% or 75% (without rescaling per-contact transmissibility), to reflect emergence in a rural community, the epidemics went extinct 94.5% or 99.6% of the time, respectively…The high extinction rates we inferred suggest that spillover of SARS-CoV-2-like viruses may be frequent, even if pandemics are rare.

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services.

Active Discussions

-

Such an Exciting and Opportunity-Filled Time to be an Infrastructure Investor JRo,

-

United Rentals Acquiring H&E Equipment Services in ALL CASH Deal JRo,

-

"Generational" Growth Opportunity for Infrastructure According to Goldman Sachs JRo,

-

“$2 trillion in hyperscaler cloud capex could be deployed in the next five years” JRo,

-

Excellent letter from Samantha McLemore (Bill Miller’s #2 for 20 years) Cale,

- Terms of Service

- Useful Hints and Tips

- Sign In

- © 2025 Spoke Fund® Boards