-

Cale

February 23, 2021

Cale

February 23, 2021

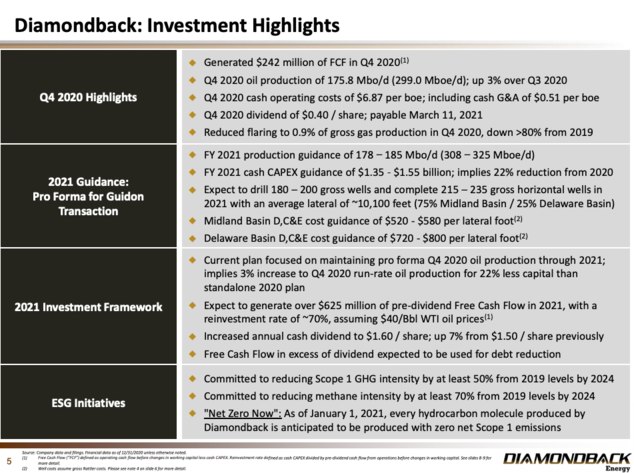

Notes on $FANG Q4 Call

Release was here, my initial thoughts on their quarter were here, and the full slide deck is here. Select slides included below.

Notes below from a same-day replay, shares up 0.5% here a few hours after live call.

Couple of earlier positive sellside comments can be found on this thread.

Call Notes:

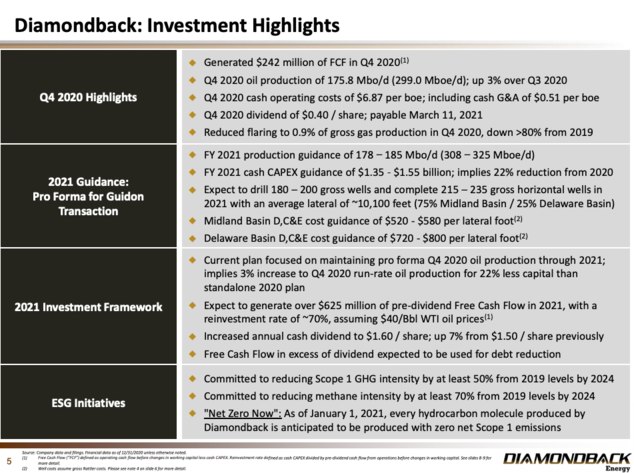

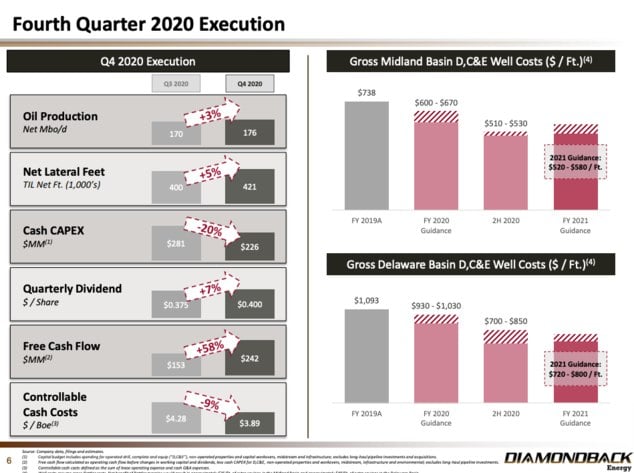

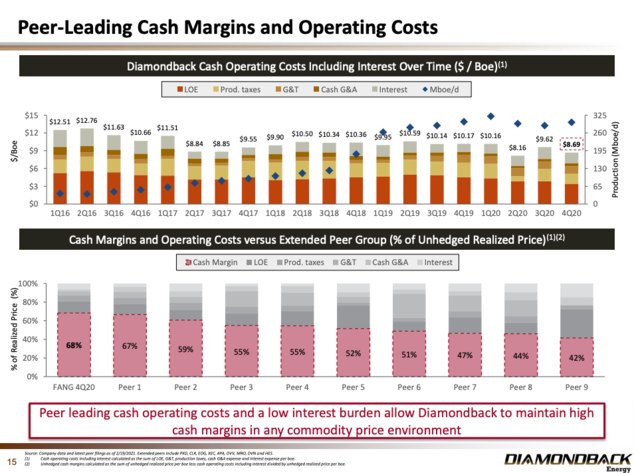

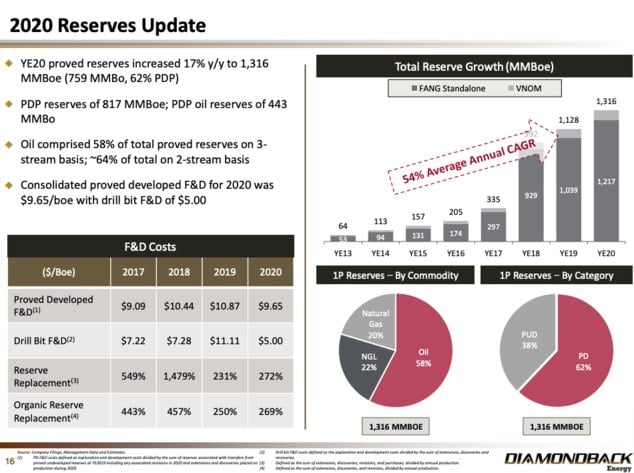

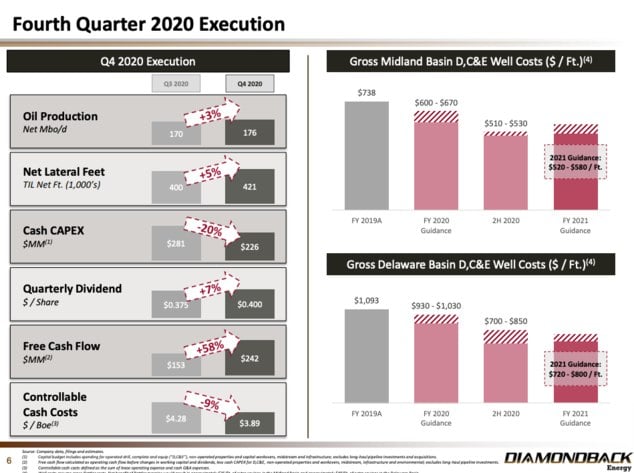

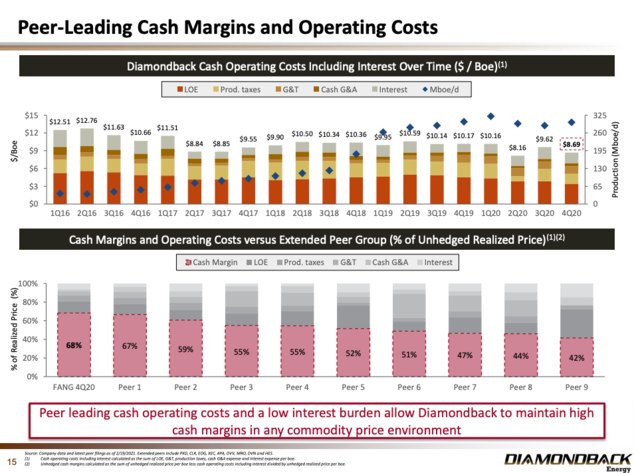

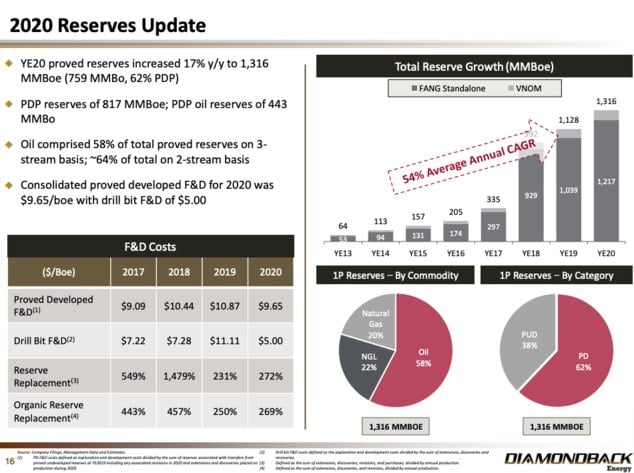

CEO: benefits of strategy to move to most productive areas in Q2 paying off in cap efficiency and early well performance. Well costs and cash opex near all-time lows. Avg completed lat length > $14K feet, record. Will translate to returns for shareholders.

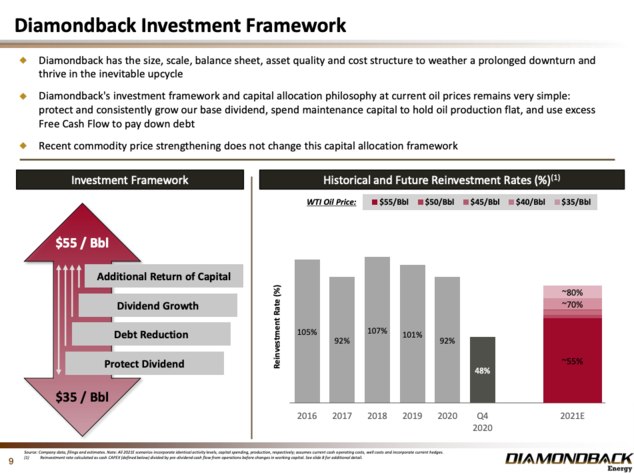

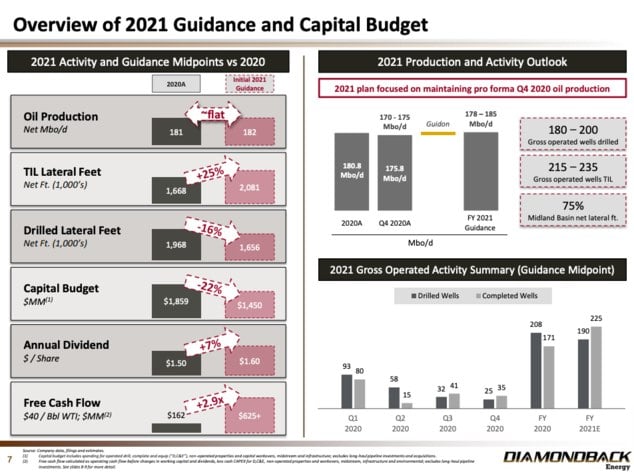

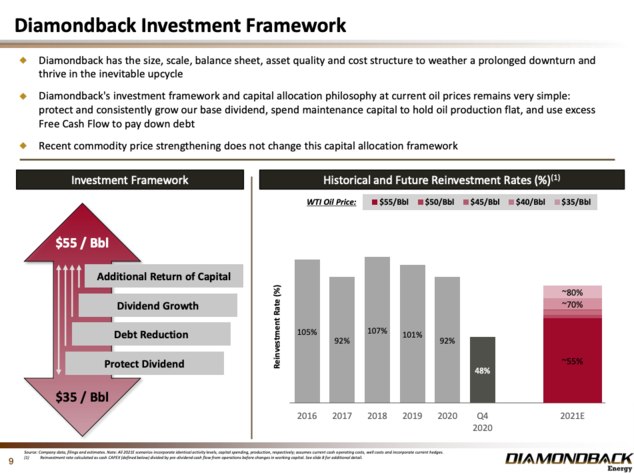

Same good quote from release here re: market supply being purposefully withheld...no need to grow oil production into artificially under-supplied market. Instead, Q4 production flat, generate FCF for divvy and debt paydown. 7% bump in divvy. Capital allocation philo unchanged: hold production flat, FCF used for divvy and debt. Those two not mutually exclusive, most FCF for paydown this year.

Q4 - FCF up 58% to > $242M

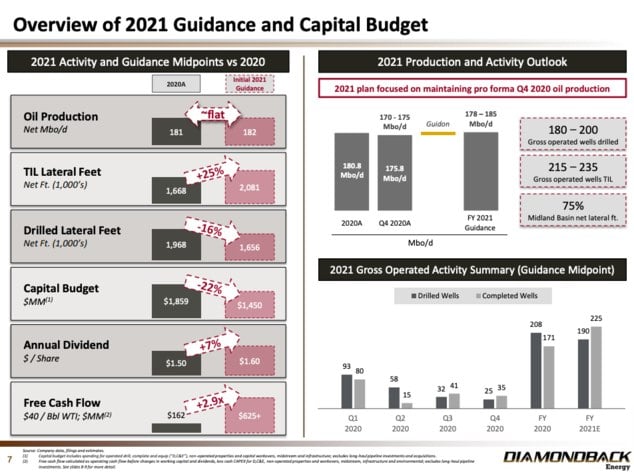

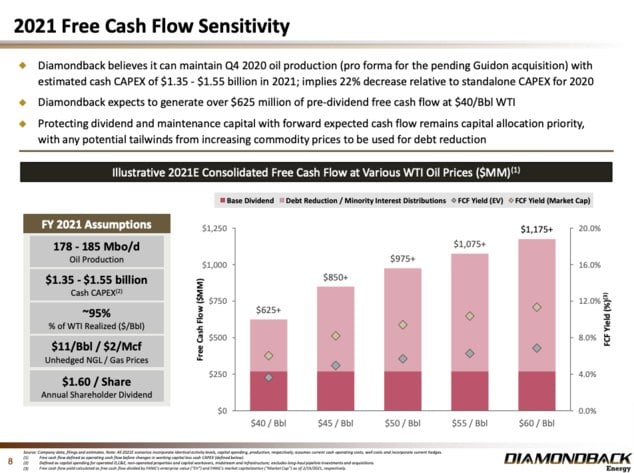

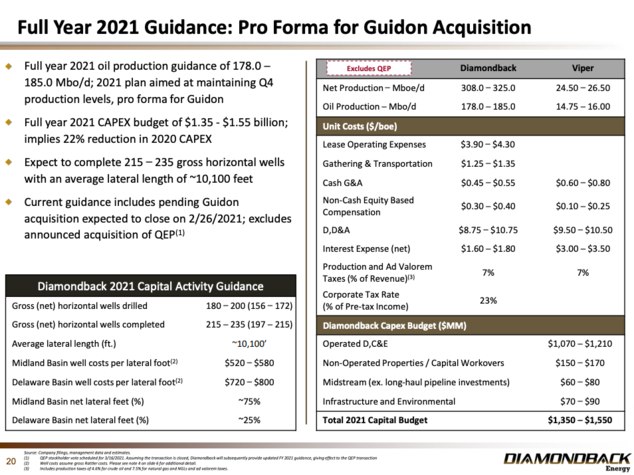

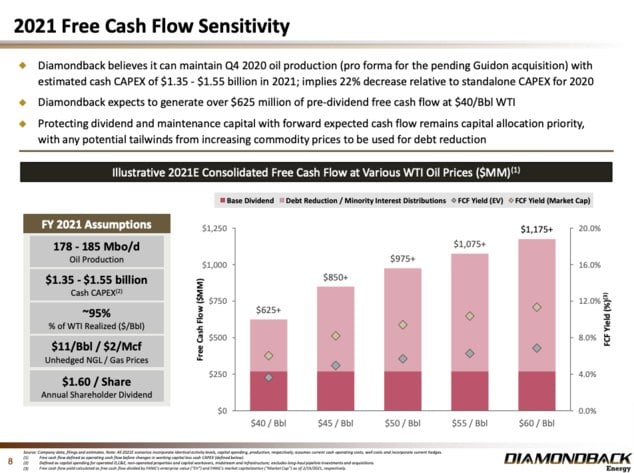

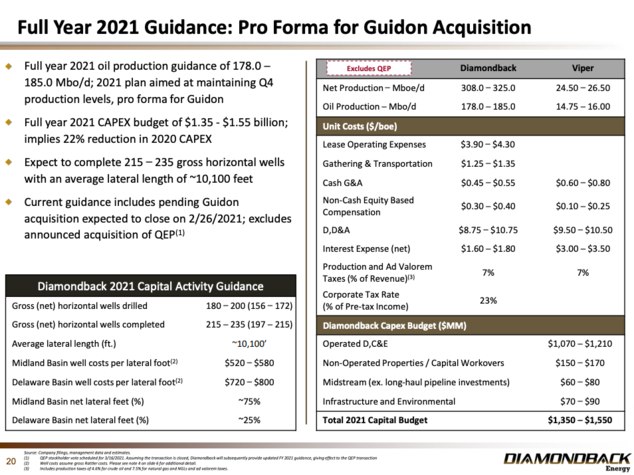

Expect to generate $1B of FCF at $50 WTI (w/ Guidon) this year (but no QEP in there yet). Reinvestment ration sub 60%, midpoint of cap budget.

Production guidance - assumes Q4 flat plus Guidon flat. Includes last week's freeze...all production down for 4-5 days. Back now, will make up over year.

QEP vote on 3/16, should close soon after. New guidance and plans then. Q1 will be noisy, but will clarify in Q2+.

Will retire '21 note later this year with cash on hand, no obs til '24, high yield in '25 also callable - will do with FCF.

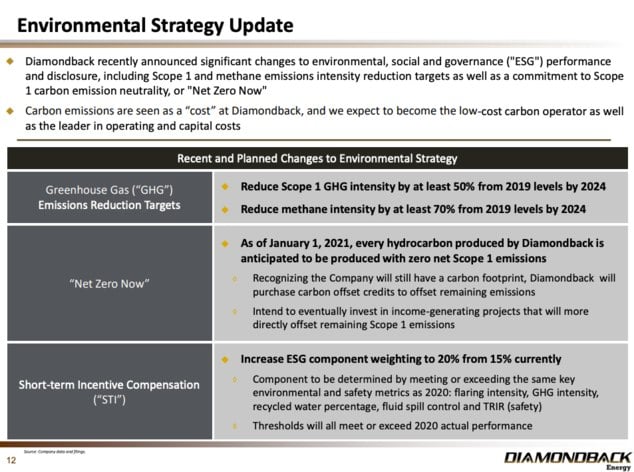

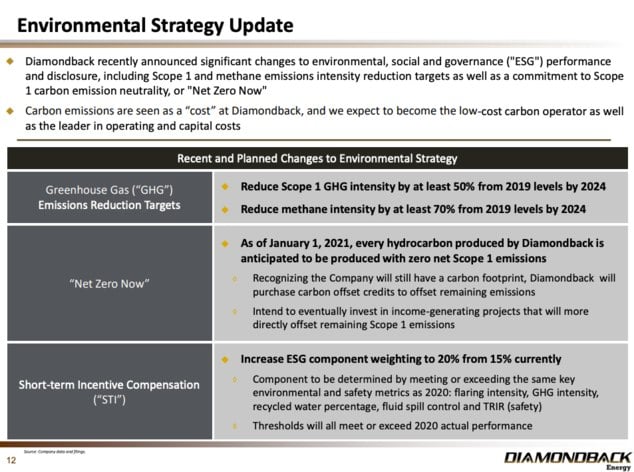

Major ESG initiative announced - deets on Scope 1, slides 13 and 14...flaring down 90% from 2019. Will spend $15M/year next four years on pneumatic controls for methane. Net zero now initiative - plan to buy offsets here. Looking for more projects that gen income eventually, credits the bridge.

Targeting a high level of responsibility - right thing to do, and will have to compete for capital that way, too. Carbon emissions are a cost and working to become low carbon operator.

Significant, consistent FCF generation >> returns to shareholders. Will update on plans when practicable.

Going to Q&A at minute 10.

Q1. JPMorgan. Pro-forma model with QEP, we see $1.4B of after-divvy FCF next 5 years...or $7B...you talked about paying off $200M debt later this year...plans longer-term for deploying excess cash?

A. Good problem to have. Cost structure enables us to do that. Leaning into base dividend talked about at board. Problem of blessings to have that kind of FCF. Will continue to work quantum of debt down. Not going to grow production with that FCF - no fears there, that is just off the table.

CFO noting anything maturity pre 2029 on table for paydown, set biz up with 1 turn permanent leverage, maturity over 10 yrs at $50. Front end of curve, all eligible for paydown, can also continue debt paydown too.

Q2. Color on costs in Midland Basin guide re: Guidon?

A. Not gonna guide to all-time low costs, at $500 to $520 per foot, service guys suffering too. Midpoint of guide 8 to 10% above well costs today, hope guys can keep and outperform. Will probably see service cost pressures rest of year.

Q3. Dingman at Truist. Benefits of tweaking G&P assets and contracts a while back given storm last week? All done?

A. High flaring number in 2019, due to our gas processor losing money on % of proceeds of contract, so sent us more than fair, so converted to fixed fee deal. Flaring numbers down dramatically. With NGLs and gas rallying, fixed fee same, we get benefit as operator. Not a lot of impact from storm, field ops did great.

Q4. Post QEP...8 to 9 rigs? Color on D&C...where are optimal efficiencies? Crazy now, can you get even better?

A. Rig efficiencies still going up...9 rigs to drill 190 wells, 75% in Midland, all over 10k feet...but efficiencies really on frac side. Cadence of 220 to 225 completions, all over 10k feet, w/ 3 simulfrac crews, 1 spot. Can see in lateral lengths, too, > 13k avg lat feet in Q4. Want to push lat length to 12-5 or 15k foot range.

Last year, running over 20 drilling rigs, now running 7 or 8, can highgrade our rigs, and in Q2, leaned in to improve efficiencies on both sides. Made them permanent. More cashflow for shareholders.

Q5. Stephens. Net Zero Now great...expectations of offset costs?

A. Big piece on GHG are emissions reductions. Net Zero Now great addition but focus as per slide 13 and 14, will spend $15M a year converting batteries. Carbon credits - in process on contract, mid 7 figure number, not 8-figure, projects tied to carbon capture or sequestration.

Not trying to buy our way into carbon neutrality. Credits just a bridge for now. Spending money on tax credits now great incentive to not spend money later.

Q6. Color on hedging strategy?

A. Real important to deliver FCF profile. Commodities rallied since last spring, wide 2 way collars, protect divvy, not limit upside. Will continue to build book with wide collars. Will be patient. Important to guarantee returns and distributions.

On earlier question - we have a social and environ license to operate. Surprised how little cost is required to do the right thing re: methane and tank batteries. Hope other co's find same outcome. Real dollars not to drill bit, but not as bad as we thought.

Q7. Agree, a 2-3 well diversion every year. Congrats and think more companies should do that.

A. Thank you, yeah, stings a little bit but right thing to do.

Q8. Cowen. Lateral lengths...13k in Q4 but budgeted 10K this year - should lat length tick up next few years?

A. New assets fit hand in glove so can push lateral lengths for biggest operating area next few years. 10k is floor, rigs outside still, so could get up 10% possibly, will see.

Q9. On growth versus returning capital - seems sustainable at mid $30s to $40, now higher...anything change? Design at field level?

A. No, can't pay attention to weekly oil prices changes, reservoir performance key all the time. Nobody every blames you for drilling wells that are too good.

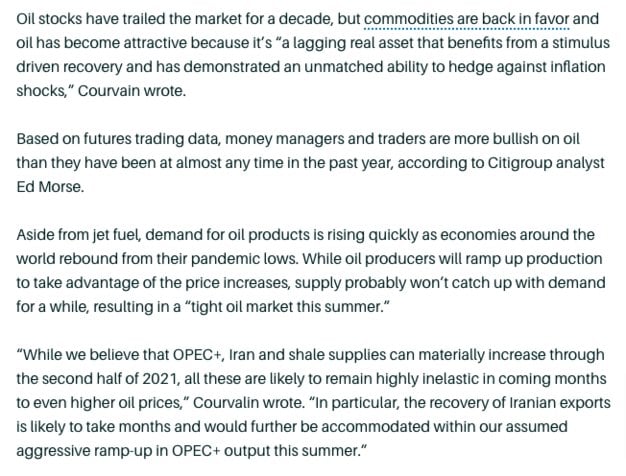

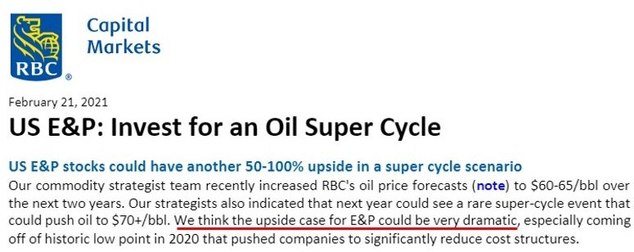

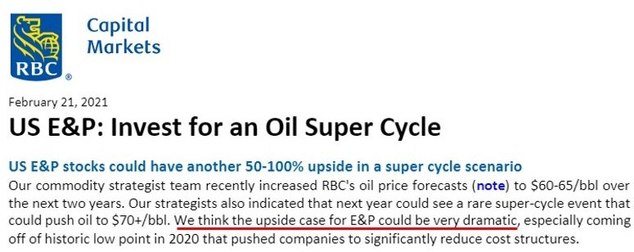

Q10. RBC. Commend for sticking to plan but lot of potential for oil supercycle MAGIC WORDS RIGHT THERE COUNT 'EM...what is plan in 2022? Limit to growth, what is acceptable? Color if stronger for longer?

A. Would be a good problem to have, hopefully on our way, but don't want to put a very complicated biz into a box in terms of growth rate. If US shale called upon to grow, would not be double digits, or zero, but is an oil price where FCF grows more if you grow slightly. We have done that work, still a ways away. Not time to talk about growth, but if was, would be sub double digits, mid single.

Can see tea leaves talking about super cycle PREACH BROTHER but not where we are today...would have to see a fundie shift. Not scared of growth...when drives incremental sharedholder returns, part of our decision making...but not good business for us right now.

Q11. Color on current production rates? At 170 to 175 on legacy, outperformed in Jan, so above now...? Color on QEP too?

A. Very pleased with op performance. Looking to keep prod and capex guide simple...we did outperform baseline last yet, fine. Nothing changed in terms of keeping newco flat thru '21. FANG plus 10 months Guidon minus storm impact (so no QEP).

Q12. What about QEP?

A. They will report soon, will update market, but can't give guidance on a deal shareholders need to vote on.

Q13. Citigroup. On base dividend - one peer said comfy at 10% of operating cash flow at their strip...how do you think about?

A. Good goal there, ours lower at $50 and at strip today. Target more consistent divvy growth over longer period of time more our focus, plus increase size of EV with FCF. This increase came a little early, but did same last year when pretty dark. Not off the table that we could revisit divvy multiple times a year from where we are.

Q14. Budget split (Midland 75%, rest to Delaware) now...will stay at that mix next few years? How would growth change that? More flex in Delaware?

A. Large block in Martin County can put a lot of work into. After QEP, Midland mix up, hope stays 75 to 85% lateral footage next 3-5 years - little lower % of total capital but high percent of net lateral footage for long time.

Q15. Stifel. Thx for taking leadership position in ESG. If invest in CCS, would do in conjunction with EOR?

A. Can't commit, but credits we have bought would give us time to study and partners here or at Rattler. Hot topic of wind and solar also in fold. Cos with large balance sheets will lead energy transition and are also O&G companies.

No specific EOR projects underway, lot of oil left in ground still and we know EOR part of our industry's future. Following a few guys very closely. Be nice if EOR and sequestration had overlap, barely getting started.

Q16. Color on clean maintenance capital including QEP?

A. Kind of what we gave, QEP has numbers out, okay to look at those. We will close in March, so on costs, midpoint of our guide 8 to 10% above current well costs, so could chop that much off if same and get good maintenance capex number.

Q17. TPH. On M&A and A&D...know may be early, but how does landscape look a bit further out - and then in sector more broadly?

A. On A&D, follow closely, lot capital going to PDP-type transactions so good for us on QEP Williston assets...hot market there. Small stuff in Permian, fully developed, doesn't get capital though.

Lot of production in hands of 10-12 companies in US, bodes well re: growth but more to do.

A&D harder to do when prices up but very comfy with our inventory and runway.

Q18. Color on mix after deals?

A. 100 to 200 bips of oil mix after - boes outperform cuz flaring down. Midland oilier, but not a huge swing.

Q19. Goldman. Perspective on what seeing others doing re: capital discipline?

A. From macro, still undersupplied on rigs to keep Permian flat. Not enough to offset production declines have seen thru lack of investment last 12 months. If oil and gas companies haven't got discipline now after covid, probably never will. Will be a time in future where we get a signal for growth, after Iran...but hypergrowth is in the past.

As low cost producer, going to drive highest returns to our shareholders.

Q20. On sequestration and clean energy - do you have competency in house, would invest...?

A. We don't have those here...that is a trap, we're not experts on that. Main thing is to produce barrels at highest cash margin at lowest cost and now lowest carbon footprint. Would participate alongside whatever carbon capture tech may me.

Q21. CapOne. More interested in carbon capture than sequestration...?

A. Too early, goal to get emissions down as much as possible. Getting into other biz is a 3/5/7 year discussion. Getting ours down, how to offset for now - smartly. We are an oil and gas producer going to be doing it a long time. Pressure only going one way, taking bull by the horns. Trying to be very specific.

Focus not on buying or way to carbon neutrality, focused on reducing emissions now, hope others look at doing more on methane, too.

Q22. Scotia. Color on return to shareholders? Criteria and priority?

A. Variable divvy or buyback worth discussing when debt at 1x at $45 to $50 so will talk about at that point. What is best return after base divvies and debt down is good question but targeting debt back down to $5.5B first.

Q23. Keybanc. Purchasing carbon offsets...that an annual number, for 3 to 7 years, color?

A. Depends on how many tons of CO2 we omit...cost down as number does. Bet carbon offset credits increase in price, so depends. Not a material expense, priority is to get emissions down.

Q24. M&A after get to target debt levels? Consolidate more in Permian?

A. Comfy now, will monitor landscape as always do, but very comfy on inventory life.

Q25. Johnson Rice. Refresh on options for QEP debt - 22s and 23s, how does play in?

A. Three notes outstanding, probably tendered and refi'd, lower interest rate. Will depend on response to tender. Our 25 notes also a chess piece. Want to take advantage of rates...paydown gross debt, lower interest rate, longer avg term to maturity.

Q26. Continuing to pick your spot, then?

A. Yeah, do need to work on covvies and reporting reqs, so will copy an existing path for handling those notes,

Q27. Assets in SE Martin - how prominent in plans?

A. Will add one net rig for Guidon, 12-13 well pad, QEP may move rigs 2-3 more, active there next 5-8 years.

Q28. Barclays. Net Zero and ESG...other options to buy offsets? Not Cali, can you participate in all credit markets?

A. Yes, and focused on U.S. credits. Projects one based in TX, one in WY, that's our start, will build good relationship with partners, invest directly at some point. Goal to make sure what we do invest in is tied to what we produce.

Q29. On income generating projects...potential carve-out down the road?

A. Getting way ahead or ourselves, but think we've proven pretty smart about spinoffs. Head might explode if thought about another one right now. Aware of those multiples, but not why we're doing this.

Gonna focus on what we're really good at, will stay there, drive down emissions intensity.

Call over minute 62. CEO final closing remarks...unprecedented weather in Permian...no power, frozen water...our field ops guys working 20 hours a day to get gas delivered to power gen plants - not for FANG, but cuz those plants were sitting idle - cuz did not have fuel. Answered the call, heroic, won't be forgotten, so thank you.

Bottom line:

Simply put, FANG is just extremely well run...and has excellent assets. Call underscored that, again. All about discipline - which shows up as free cash flow going towards debt pay-down and dividend. And now leading from out front, again, on ESG. Glad we're on the team...and even more glad we joined at that cost basis from last spring.

Select slides:

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

February 23, 2021Morgan Stanley's turn to get more bullish.

Cale

February 23, 2021Morgan Stanley's turn to get more bullish.

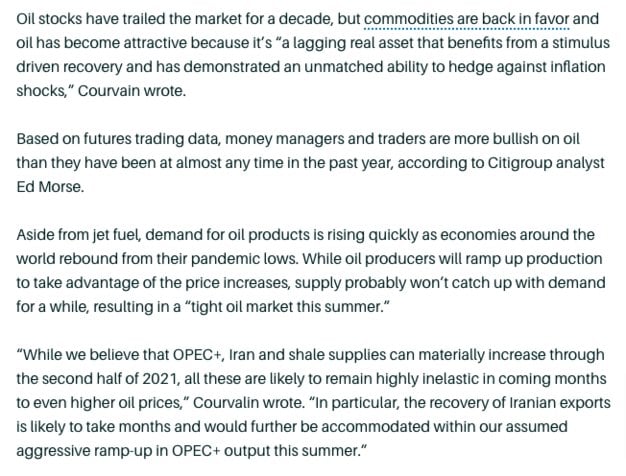

Raised their Brent forecast for Q2 to $65 (from $55), bumped up their Q3 target to $70 (from $60) and bumped up Q4 estimates to $65 from prior $60.

Their analyst also sees the oil market in 1Q in deficit by ~2.8M bopd.

My favorite line:

If sustained, 1Q could turn out to be the most undersupplied quarter since at least 2000.

You rip off that mask off right now, buddy, and and breathe as carelessly as you want.

Posted that full Morgan report "How Undersupplied is the Oil Market Really?" last night at this link.

And Goldman's "Solving for a Tight Market" report from yesterday is now on the private boards here, too.

Masks on for you, though, Goldman.

Assorted Tuesday Links:

1. Barron's on that Goldman report:

Oil at $75 a Barrel by Summer? Goldman Analyst’s Forecast Is Bullish for Energy Stocks.

2. 'Supercycle' sighting number one this morning - from El-Erian's tweet here...

3. And Supercycle sighting two, from Eric Nuttall on Twitter:

Is this how a meme works??

4. BBG: Trafigura Sees ‘Strong’ Oil Market Heading Into the Summer

Plus, about 1 million barrels a day of crude production may never come back due to the damage some oil wells incurred from the weather.

5. Co-head of oil trading at Trafigura in this BBG video, too.

Short version: at the peak of the Texas freeze, believes U.S. crude output fell by ~5m bopd. Lotta that has re-started, but still means ~40M barrels less in February than expected.

Company News:

Two upgrades so far this morning - but first, two Q4 calls.

Notes on the way, more soon.

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

February 22, 2021Broader market futures down Monday morning. Perhaps the bump in bond yields is making tech stocks look more expensive. And if so...yeah, rotate on outta there, big fellas.

Cale

February 22, 2021Broader market futures down Monday morning. Perhaps the bump in bond yields is making tech stocks look more expensive. And if so...yeah, rotate on outta there, big fellas.

WTI up 1% to $59.86, nat gas down to just under $3. U.S. energy supply in the middle of the country now starting to returning to normal.

Goldman now expects a tighter oil market on their demand forecast (higher than consensus), which should result in a stronger-than-expected rally. Now forecasting Brent at $70 in 2Q21 and $75 in 3Q21...both up $10 from prior forecast. Also noting oil should benefit from the stimulus-driven recovery, as a hedge against inflation...and that a recovery in Iran exports in unlikely in the short term.

Righty-o, my work here is done.

Assorted Monday Links:

1. Reuters: OPEC, U.S. oil firms expect subdued shale rebound even as crude prices rise

2. BBG: U.S. Says ‘Ball in Iran’s Court’ to Revive Nuclear Deal.

So both sides still passing notes during gym class. This little signal from the U.S. was likely due to Iran threatening to limit U.N. nuclear site monitoring over the weekend.

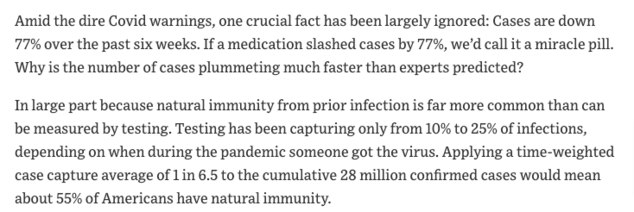

3. WSJ op-ed (from Dr. Makary at Johns Hopkins): We’ll Have Herd Immunity by April

Covid data out of Israel over the weekend also very encouraging.

4. Podcast here with Raymond James' oil axe Marshall Atkins. Short version:

He thinks that after corona, the world may need every drop of OPEC+ oil online to keep WTI from hitting $100.

What's the emoji for "I Like The Cut Of That Guy's Jib"?

5. TSE: The myth of 'electrify everything'?

Even if renewables reach 50% of the grid, there would be no net CO2 savings, while end products' costs would likely increase by 10-100%.

6. FP: Everything You Think About the Geopolitics of Climate Change Is Wrong

In reality, the geopolitical fallout of a clean energy transition will be far more subtle, complex, and counterintuitive. Many of today’s predictions are likely to turn out wrong, or will take decades to unfold in unpredictable ways. If policymakers don’t get a clear-eyed understanding of how global power relations will change—not only in a future era of zero-carbon energy, but during the long and messy transition to get there—they won’t be able to manage the coming era of foreign-policy risks, and their efforts to combat climate change will be stymied.

This Week's Sign We're Heading Towards an Energy Crisis:

Yet another reminder that emotions, not rationality, are driving the debate...

From the New Yorker: The Activists Who Embrace Nuclear Power

The hopeful way to go into that is, ‘Oh, wow, we actually have technology that can do this. And that’s nuclear. And so I’d rather stay hopeful.

Today's Sign That EVs and Renewables Are A Bubble:

Three SPAC mergers already announced this morning...and looks like at least two more on the way.

Company News:

[More company-specific commentary this morning for IIM investors can be found on the boards here at this link.]

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

February 21, 2021Most posts on this site are private, for the investors of Islamorada Investment Management.

Cale

February 21, 2021Most posts on this site are private, for the investors of Islamorada Investment Management.

This blog contains public posts - viewable by all site visitors.

For compliance reasons, we still have to restrict certain kinds of content even in these public posts - but we're excited to soon be announcing more public features, accessible by investors everywhere.

In the meantime...

For access to comments and downloads on these public posts:

Please click the "Create Account" button in the top corner of this page.

Public areas of this site:

Other links:

- What's a Spoke Fund®?

- To learn more about becoming an IIM investor: www.IslaInvest.com

- To apply to launch your own Spoke Fund@ at IIM, please go here

- To receive our research reports, sign-up here

-

Cale

February 18, 2021

Cale

February 18, 2021

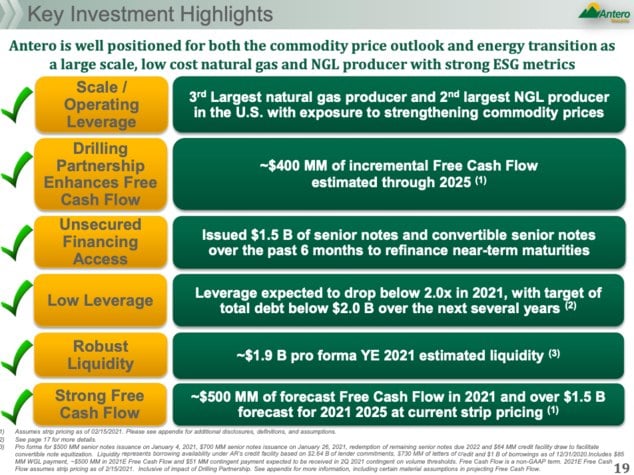

Notes from $AR Q4 Call

Release here, my initial thoughts were here, full preso is here.

Shares down 10.5% at start of call, though likely more on the dividend cut at $AM then about $AR results, specifically.

Call Notes...

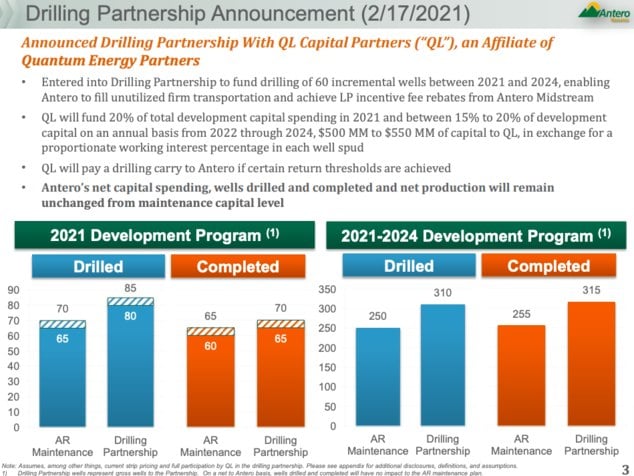

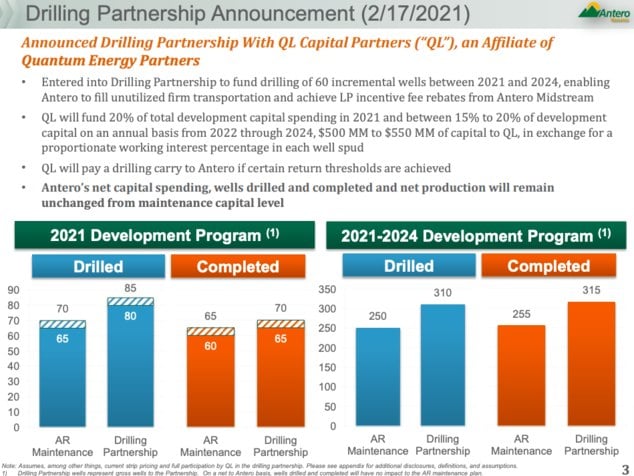

CEO - kicking off with comments about drilling partnership. Same deets as on release. Starting with wells spud 7 weeks ago. Slide 3...

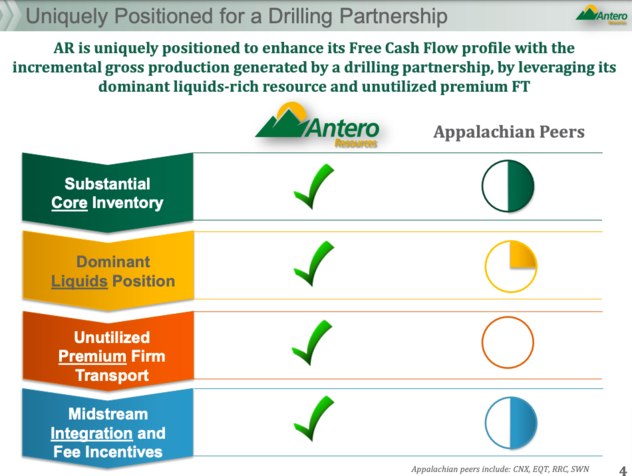

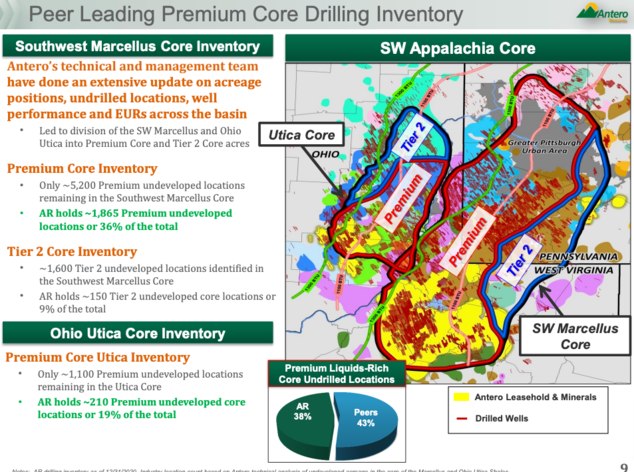

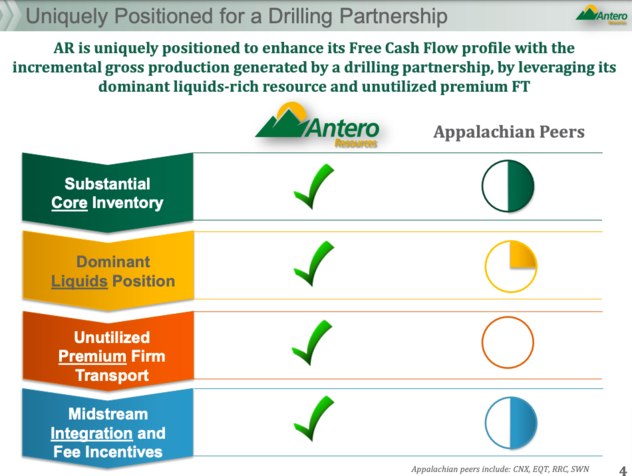

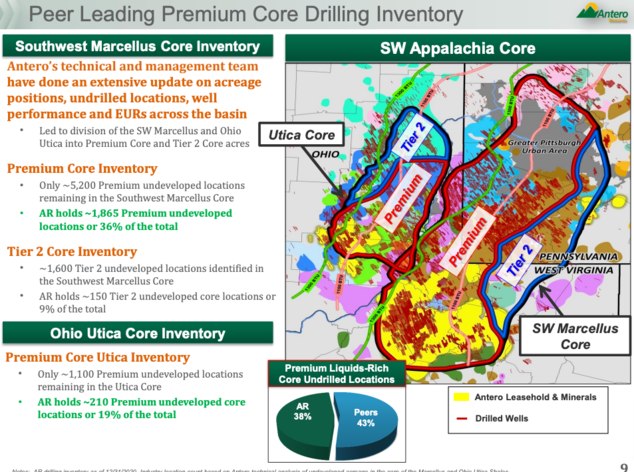

Slide 4: over 2,000 premium undeveloped locations, contiguous, more efficient development. Since more than 1400 are liquids rich, well-positioned to take adv of strong NGL prices. Recent study of undeveloped locations in Appa, 1400 represent 38% of remaining core.

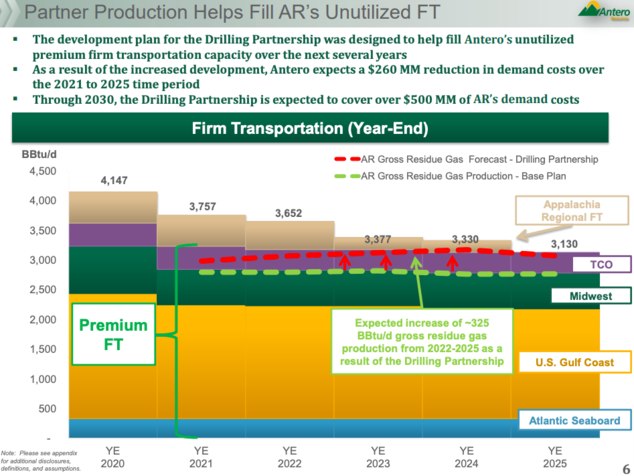

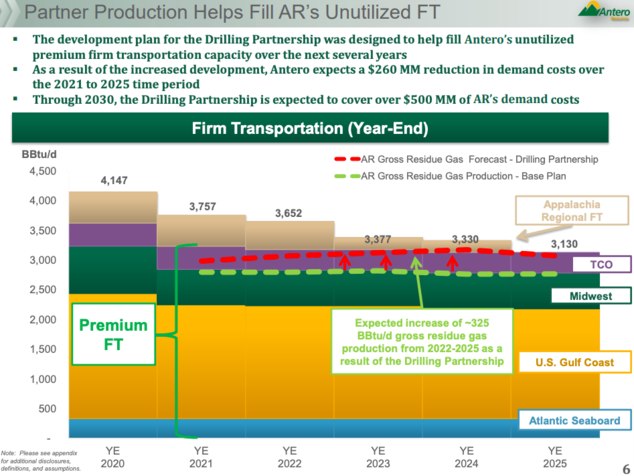

Have underutilized FT, can deliver where others can't. They have basis blow-outs, have to shut-in.

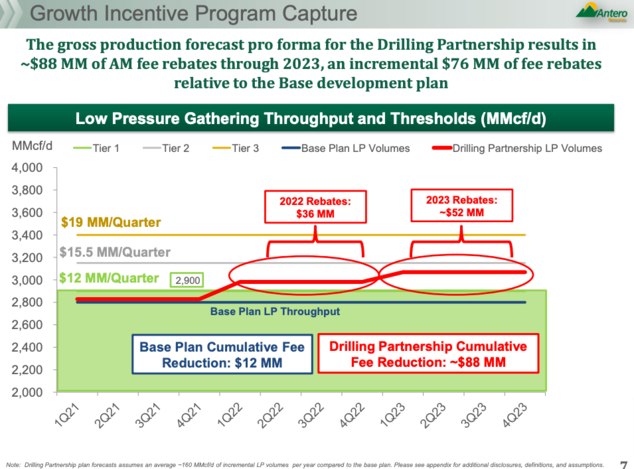

Can capture add'l fee rebates thru partnership, too.

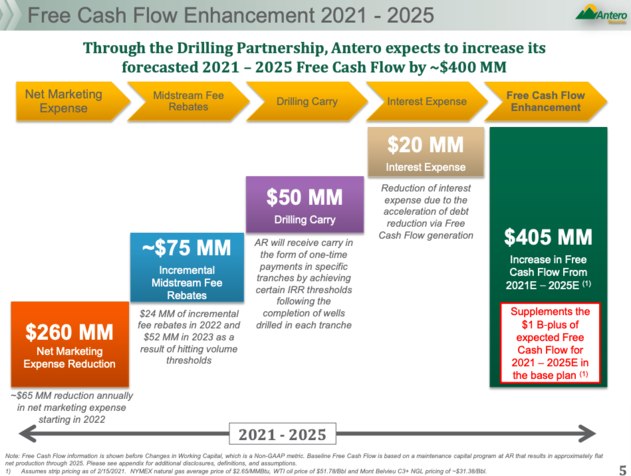

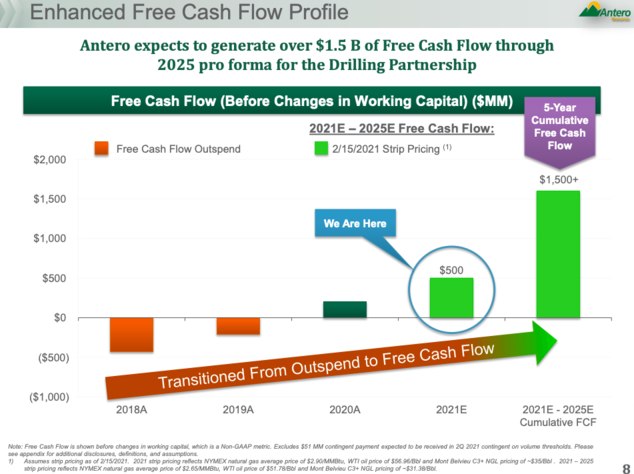

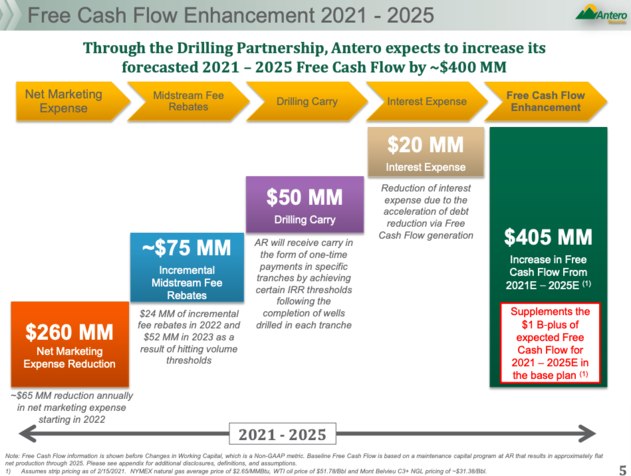

All of that will drive big increase in FCF as per Slide 5. Red box can fill un-utilized FT. Bennie really kicks in 2022.

Walking thru waterfall.

Most of $400M in FCF not very sensitive to commodity prices.

Slide 6 - highlighting gross volume forecast. FT filled by 2023.

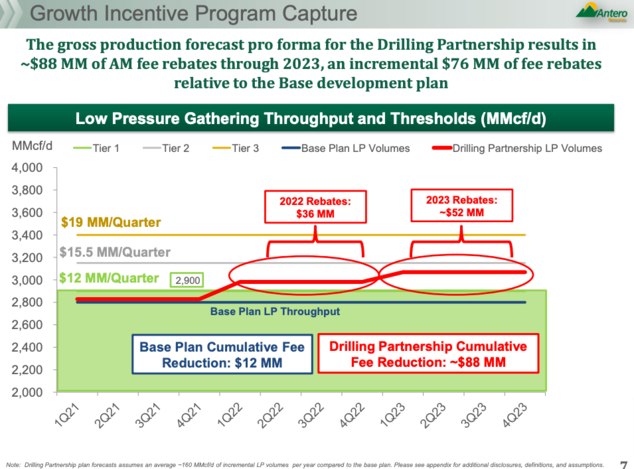

Slide 7 summarizing rebates thru AM. Earn outs possibly more than that $76M. Also is an IRR-target kicker.

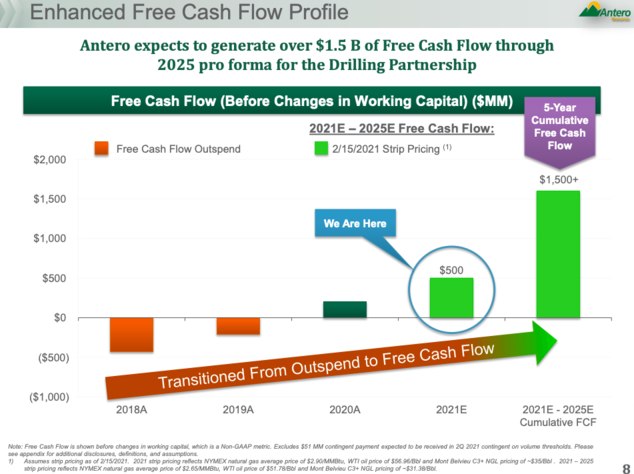

Slide 8 - partnership will boost FCF by $400M incremental. FCF based on backwardated strip, though. If flat, would expect to gen $3.5B in FCF...35$ NGL and $2.90 gas.

Slide 9 - recent testing, bifurcating the cores. 5200 premium undeveloped in SW Marcellus in red. Of that, we hold 1865 locations, 36% total. Ohio Utica, we hold 19%. Then 1600 Tier 2 in blue lines. Existing production covers a lot (red lines) but partnership highly accretive. Inventory fatigue and inventory will be a critical point.

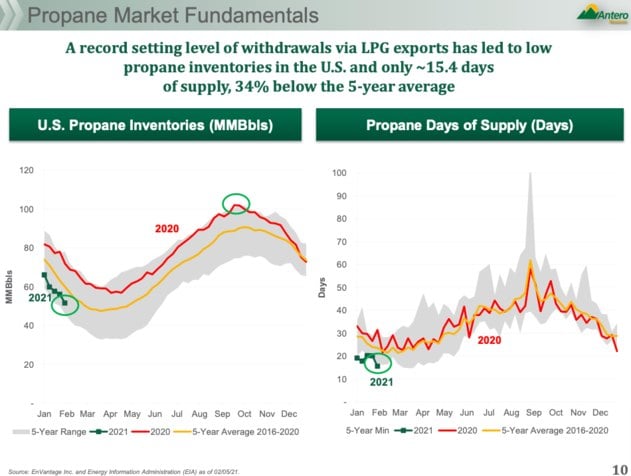

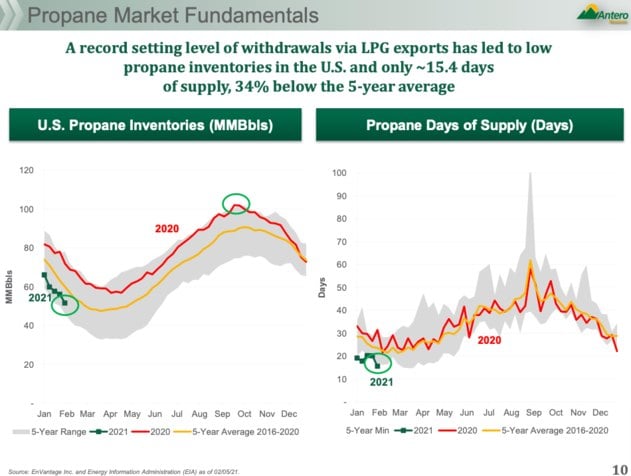

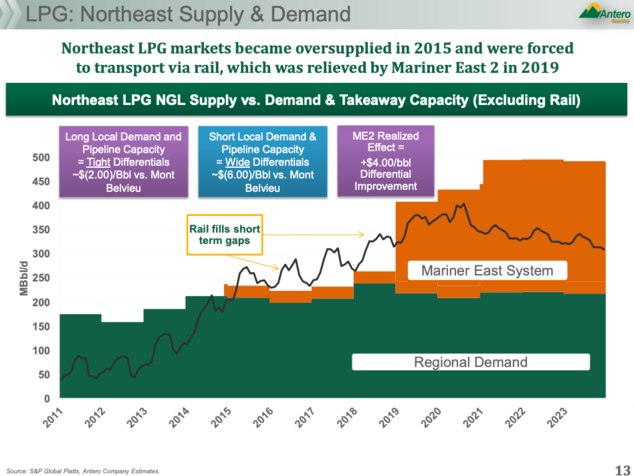

Marketing guy now, talking LPG...see slide 10.

Record setting rate of withdrawal for LPG. Big swing in inventories and days of supply (as per my note yesterday).

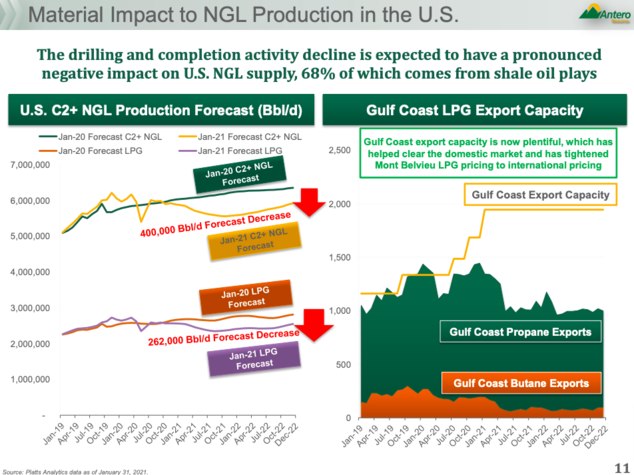

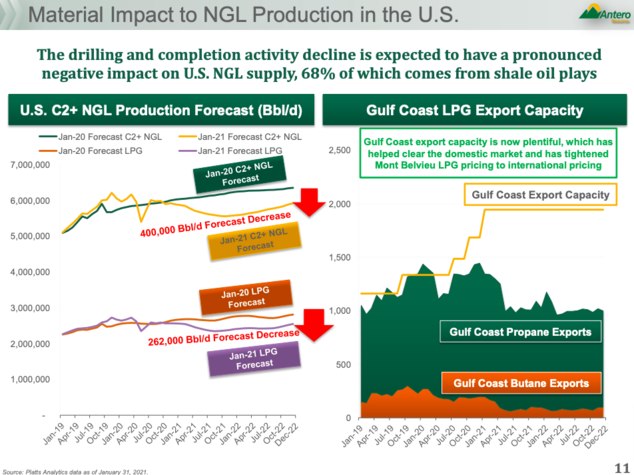

Slide 11 - U.S. exported record levels, winter not yet over. Mt B prices low 50 cents in Nov to 98 in January, now at 90 cents, stay tuned for recent impact due to Arctic blast. $39 barrel today.

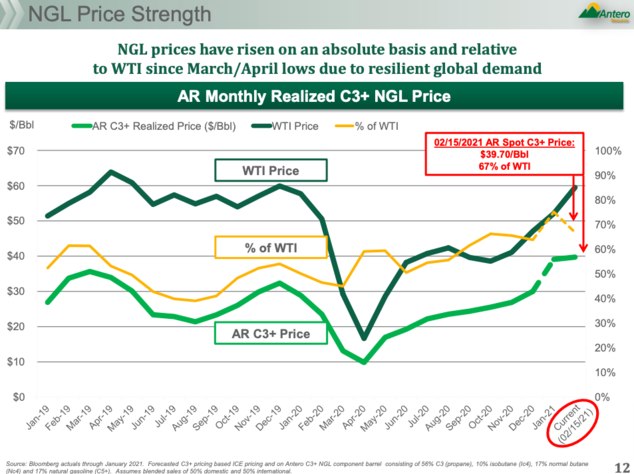

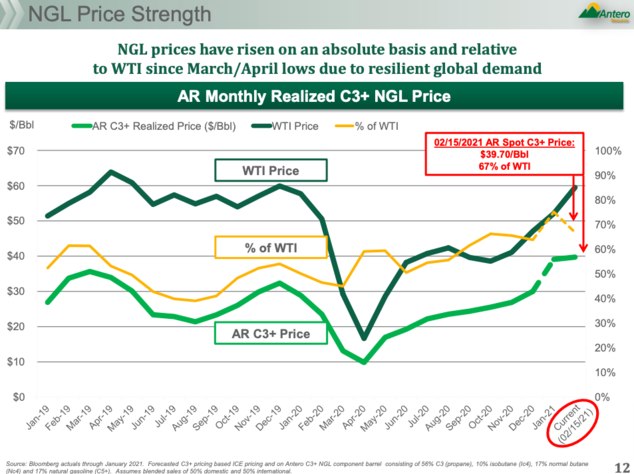

Slide 12 - steady increase in C3+. Upside remains in curve, lack of contango for next winter. LPG adoption should be embraced, numerous petro-chem coming online. China 350k barrels of demand per day thru 2022.

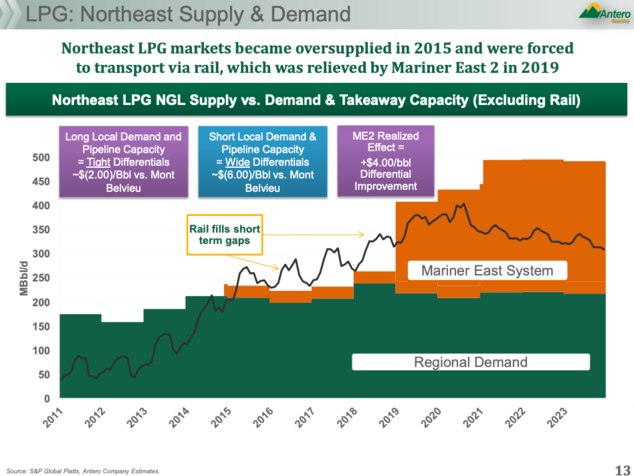

Slide 13 - improving realizations, LNG carrier changes in Panama means shipping advantage to Europe and Asia. De-bottlenecking real positive.

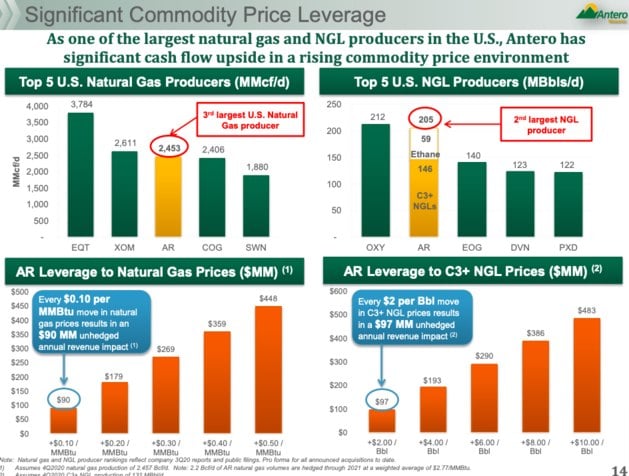

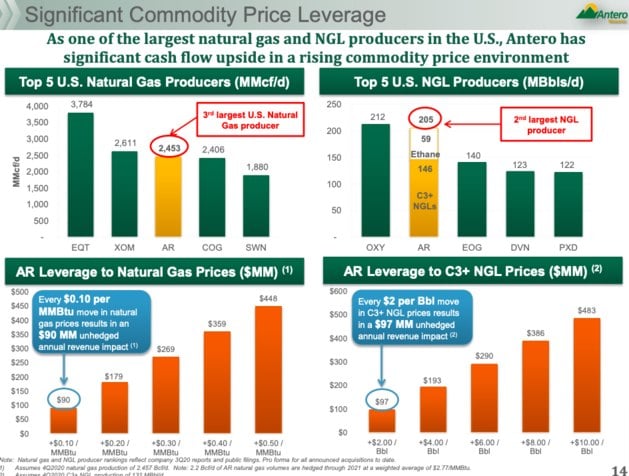

COO now - bullish LPG good for us. Speaking to slide 14...$2 per barrel change in NGL price = $97M in unhedged revenue per year.

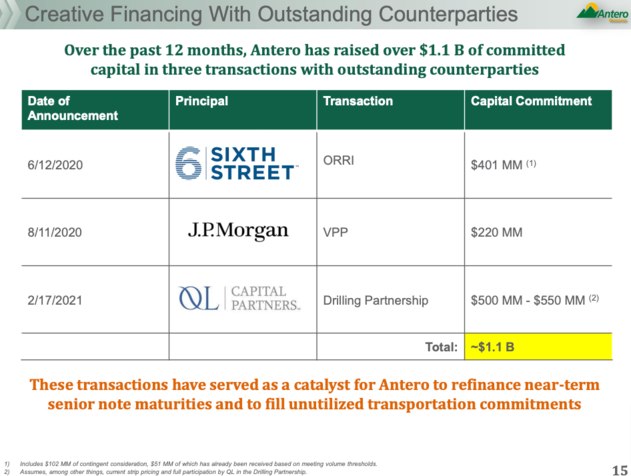

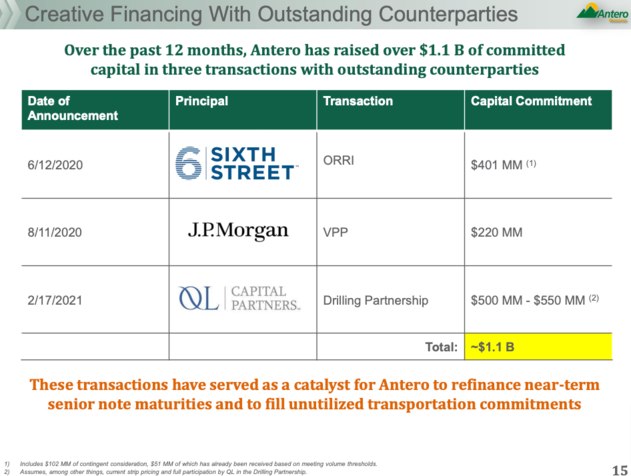

Slide 15 - have raised over $1.1B, three great counterparties. Strong endorsement of our assets.

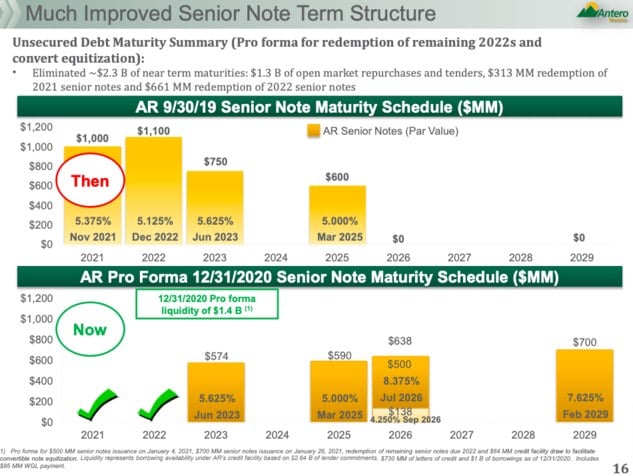

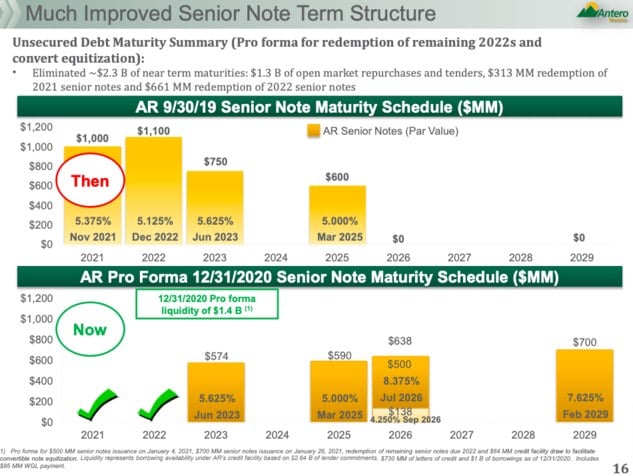

Slide 16 - walking thru new maturity schedule, dramatic improvement.

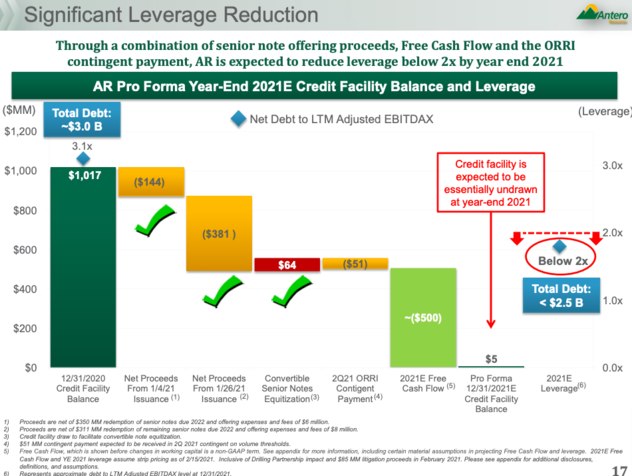

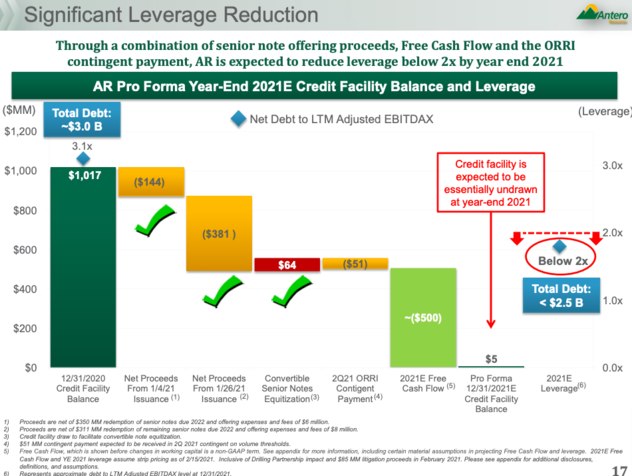

Slide 17 (new one for them) - that "below 2x" will be critical for them.

Now shifting to financial highlights for quarter...deets as per release here, FCF, wells, ten set new record...perfunctory ESG slide...still targeting methane loss and GHG intensity. Believe NG will be key for energy transition, well-positioned there. Uniform reporting standards for ESG are on the way.

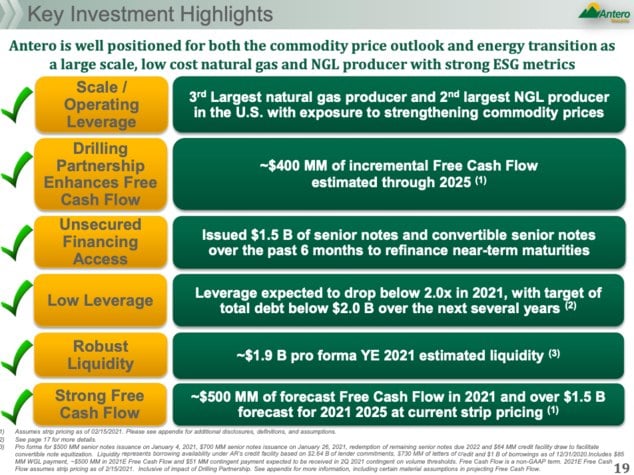

Slide 19 - summary...making good point about FCF versus current market cap...walking thru bullets here.

Going to Q&A at minute 24.

Q1. JP Morgan. Color on 2021 liquids guide relative to 2020? Mix 33% to 31%? Royalty barrels impact on volume guide?

A. We elect not to pay royalty owners in uneconomic NGLs, like 2020, so do not pass that along. With increase in '21, won't do that. So last year paid in NG volumes, now will pay in share of liquids. Huge benefit to AR. Neg $50M for us last year, reverses this year so higher realizations and lower processing costs at lower net production.

Q2. Color on marketing uplift in Q1 here (re: this weather)?

A. Guidance does reflect that now, would have been flat, now $75M in new rev...$50M in realizations, rest in lower marketing expense. So flat to ten cents and now ten to 20 cents in Q1. Just so far...

Q3. Northland. Capex $635 per foot, looks like will be here second half of this year. How conservative are ya being next four years?

A. Yeah, probably conservative, can probably take it lower (attn: sandbagging alert). Still downward pressure on service costs.

Q4. NGL volumes this quarter? Exports same as Q4...?

A. Gross wellhead vols flat YOY, maintenance capex volumes, so NGL vols Q1 will be down as per guide due to lack of completions in Q4. So, no changes to export mix.

Q5. Truist. How think about FT commitments and new drilling on slide 6...changes versus previous expectations? Fees/expenses?

A. All still does roll off...no expense by YE '25, can also see that in the guide.

Q6. Capex and production guidance - drivers of delta?

A. Nothing really changed, just $10M in capital, but avg for 2020 high enough given specs of deals last year.

Q7. TPH. Capital allocation across portfolio - Marcellus/Utica mix, and premium/Tier 2 in Marc?

A. All in premium bucket over next 5 years, 98% Marcellus, more deets in preso coming out later today.

Q8. Confirming maintenance on net basis for capex for whole drilling partnership for 5 years...?

A. Yes, holding maint capex there for 5 years, spending little less pre-carry, actually. To generate max FCF and paydown debt.

Q9. RR Advisors. If do $500M EIBTDA in Q1 and all RCF paid off by June, how will allocate FCF later? FCF yield in excess of 25% at this point, eh?

A. Yeah - and that's holding gas flat at $2.90 and NGLs at $35...first use of proceeds to paydown debt and credit facility til get below 2x. Then return of capital to shareholders. May be some A&D along way, will see, but potentially buybacks and divvies. Will look at every quarter.

Q10. Looks like you could almost take yourself private with that FCF over next 2 to 3 years, right...?

A. Thank you.

Q11. Howard Weil. On Slide 9 - impact on overall view on M&A?

A. Not driven to do M&A for inventory reasons, 80 locations per year with partnership, so many many years of running room and inventory. Other reasons for M&A, of course. Basin doesn't have that many years of inventory...so should see higher prices...but if run 30 rigs (today 26/27) in Utica and SW Marcellus can drill 30 wells per year. So doing the math...only six years of supply in premium area of SW, which is pretty sobering.

Q12. Points to more consolidation...?

A. You're probably right.

Q13. On prior commentary on NG prices - what will take to flip the switch like Q1 '18 on net marketing expense?

A. Similar, still ongoing today. Gonna be interesting six weeks.

Q14. Do you have a % to share on how much can sell in spot?

A. Yeah, in the 450 to 500MM/day range depending on pipe capacity...to Chicago, midwest or Gulf Coast, so pretty significant.

Q15. Wow. (You got that right, sister.)

That's it, call over minute 43. Stock off earlier lows, now down 7% on the day. Sell-off is shortsighted here, though. Shouldn't last.

Keep you posted on Street ratings/target changes.

Shifting gears for $AM call, back after that

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services.

Active Discussions

-

Such an Exciting and Opportunity-Filled Time to be an Infrastructure Investor JRo,

-

United Rentals Acquiring H&E Equipment Services in ALL CASH Deal JRo,

-

"Generational" Growth Opportunity for Infrastructure According to Goldman Sachs JRo,

-

“$2 trillion in hyperscaler cloud capex could be deployed in the next five years” JRo,

-

Excellent letter from Samantha McLemore (Bill Miller’s #2 for 20 years) Cale,

- Terms of Service

- Useful Hints and Tips

- Sign In

- © 2025 Spoke Fund® Boards