-

Cale

March 1, 2021Bonds rallying, broad market futures up, WTI up 1.2% to $62, nat gas flat.

Cale

March 1, 2021Bonds rallying, broad market futures up, WTI up 1.2% to $62, nat gas flat.

Coronavirus numbers continue to improve. CDC approved the single-shot J&J vaccine last night. Rollout will be immediate.

Through peak earnings week for Tarpon. See the weekend post for a summary of links. Still playing a little catch-up on watch list names today.

OPEC+ monitoring committee meeting on Wednesday, and then The Show is on Thursday. And in case you missed it, here were my thoughts from this post last week:

>>>

>>>

Today's Sign Renewables Are A Bubble:

Hindenberg on clean energy firm $ORA: Ormat: Dirty Dealings in ‘Clean’ Energy

Today we reveal how ESG-darling Ormat, a developer and operator of geothermal power plants, has engaged in what we believe to be widespread and systematic acts of international corruption.

Not endorsing any opinions here - I don't know Ormat nor Hindenberg well - but IMHO of note because these sorta allegations seem to pop-up in the late stages of a bubble.

Monday assorted links:

1. Platts on this week's OPEC+ meeting:

Rallying oil market has OPEC+ priming the pump, as ministers balance caution with profit

2. WSJ: Iran Rejects Offer of Direct U.S. Nuclear Talks, Ratcheting Up Tension With West

Iran looking for leverage. Skeptical they will get much.

Iran rejected a European Union offer to hold direct nuclear talks with the U.S. in the coming days, risking renewed tension between Tehran and Western capitals.

Senior Western diplomats said Iran’s response doesn’t quash the Biden administration’s hopes of reviving diplomatic efforts to restore the 2015 nuclear deal, struck between Iran and six world powers and abandoned by the Trump administration in 2018. But they said it seemed to set a deadlock: Iran wants a guarantee it wouldn’t walk away from a meeting with the U.S. without some sanctions relief, which Washington has so far ruled out.

Also saw reports over the weekend that Iran fired missiles on an Israeli vessel, and that Israel fired on Iranian positions in Syria.

3. Reuters: Biden in no rush to lift Venezuela sanctions, seeks 'serious steps' by Maduro

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

February 26, 2021S&P 500 on track for worst week in a month. WTI down 1.8%, nat gas down 2.4% this morning.

Cale

February 26, 2021S&P 500 on track for worst week in a month. WTI down 1.8%, nat gas down 2.4% this morning.

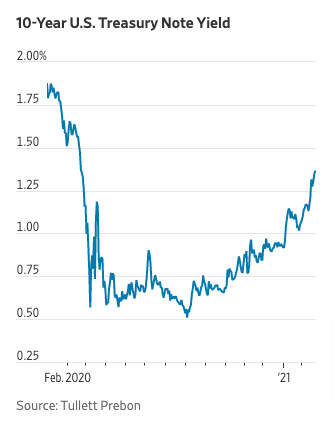

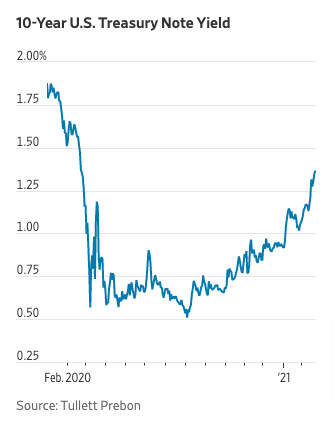

Tough few weeks for Treasuries.

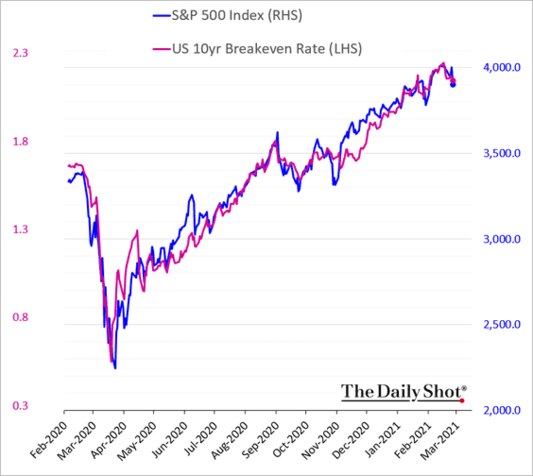

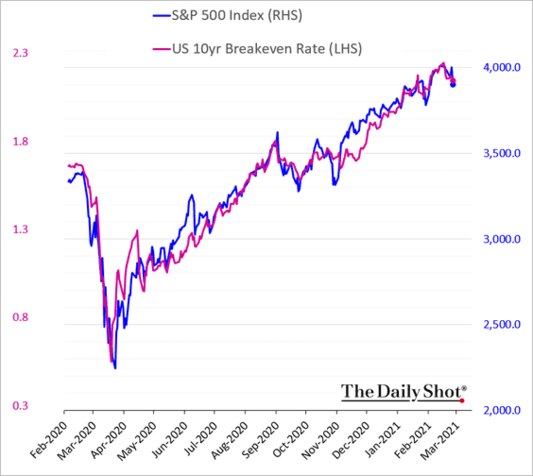

Saw that strong economic data in the U.S. yesterday put more pressure on 'em. Spooked traders, causing a notable drop in the Nasdaq. 10-year hit 1.50%...highest since February 2020. Market expecting a stimulus-driven spike in inflation, apparently...but further out looks like price gains slowing.

Correlation between the S&P 500 and 10-year over the past year has been notable...

Not a bond guy, but feels like the first fundamental-driven wobble now seeing a bit of piling on. Unclear if this Treasury selloff is overdone in the short-term or not...but at some point, U.S. of A. debt will get increasingly attractive in Europe and Japan, eh?

Back closer to home, on the energy front...

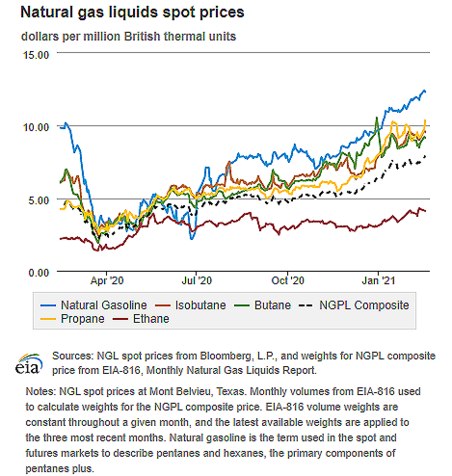

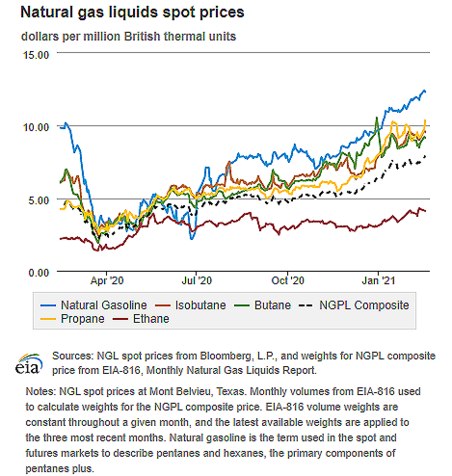

Latest on NGL prices:

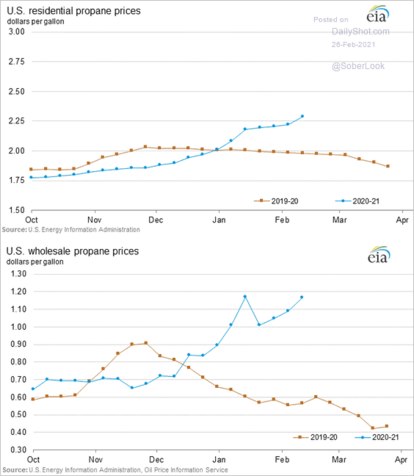

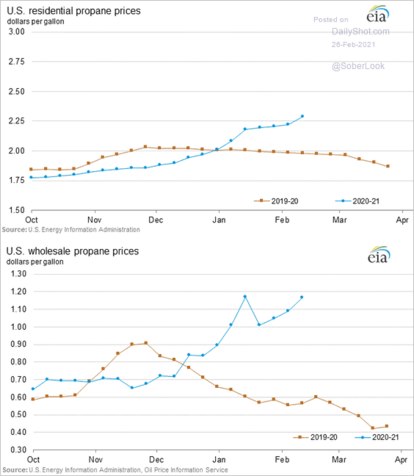

EIA on propane inventories falling, pushing prices higher:

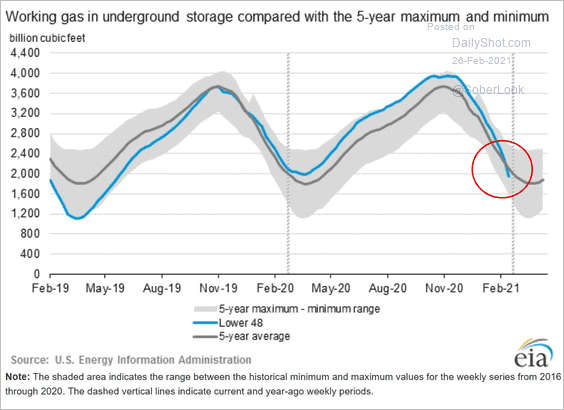

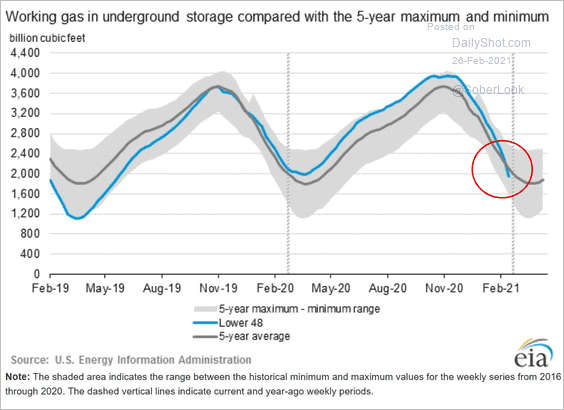

EIA on nat gas inventories, now below the 5-year average:

And ya know it's coming...

Today's 'Supercycle' Sighting:

BBG: When Does a Commodities Boom Turn Into a Supercycle?

Can that be right now?

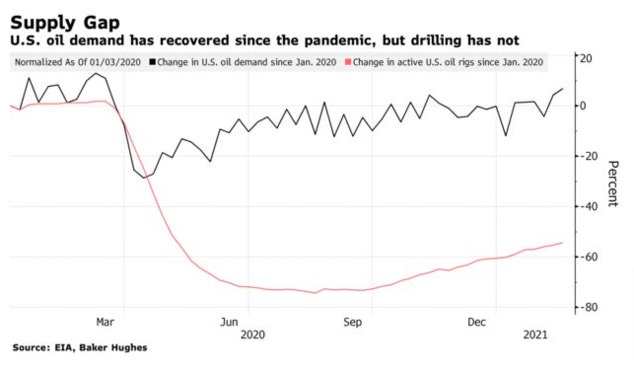

Today's Sign We're Heading Towards An Energy Crisis:

From the G&R link Ryan posted yesterday...

We are making a terrible mistake when it comes to future energy policies. In previous letters, we have touched upon the challenges of the so-called “energy transition.” Today, we will explain in detail the imminent harm awaiting investors and policy makers who fail to acknowledge certain realities. Every green energy proposal we have examined relies on the trifecta of wind, solar, and electric vehicles combined with various battery technologies. In recent months, a renewed “hydrogen mania” has broken out as well, which adds a fourth leg to the green energy stool. Unfortunately, based upon our extensive research, these plans, including the current hydrogen craze, are bound to at best severely disappoint and, at worst, outright fail in what they attempt to accomplish...

Vaclav Smil, Distinguished Professor Emeritus in the Faculty of Environment at the University of Manitoba, is the best energy scholar we have ever read, in our opinion. In his Energy Transitions, he notes that historically a new energy source takes between 40–60 years to gain significant market share. The current proposals assume wind and solar will make comparable gains in only 20 years. Ambitious plans often carry ambitious budgets, and the green energy transition is no exception. Using extremely aggressive cost saving assumptions, a widespread move to renewable power is expected to cost $70 tr over 20 years, nearly $50 tr more than if we stayed on the current trajectory. Unfortunately, our research tells us this additional spending will not even come close to generating the expected reduction in global carbon. The sums involved are monumental, and much of it could fall into the category of “malinvestment” with disastrous results. The further down the current path we go, the less likely we will be able to change course later. A decade ago, a series of failed promises and bankruptcies plagued the battery industry, making it nearly impossible for subsequent ventures to find financing and move forward. We worry the same could occur on a much larger scale if tens of trillions of “green” investments are eventually written off.

Good throughout.

Friday assorted links

1. CNN: U.S. carries out air strikes in Syria targeting Iranian-backed militias. Thx for the heads-up, Lance.

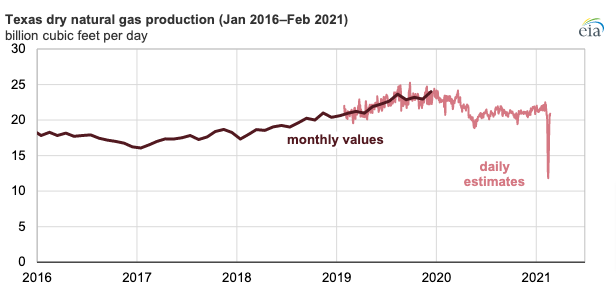

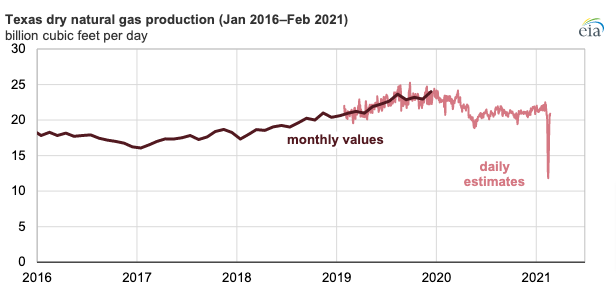

2. EIA: Texas natural gas production fell by almost half during recent cold snap

3. Unowned $EOG forecast crude oil output this year between 434,000 and 446,000 bopd - basically flat to the 444,800 bopd rate of Q4 '20. Another good sign of discipline in the shale patch.

4. BBG: Dot-Com Survivors Have Wisdom for the GameStop Crowd

Montanaro liked to call Moffitt “lobsterboy” because he had joined the company after working on a lobster boat — which is where he got his first taste of investing.

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

February 25, 2021

Cale

February 25, 2021

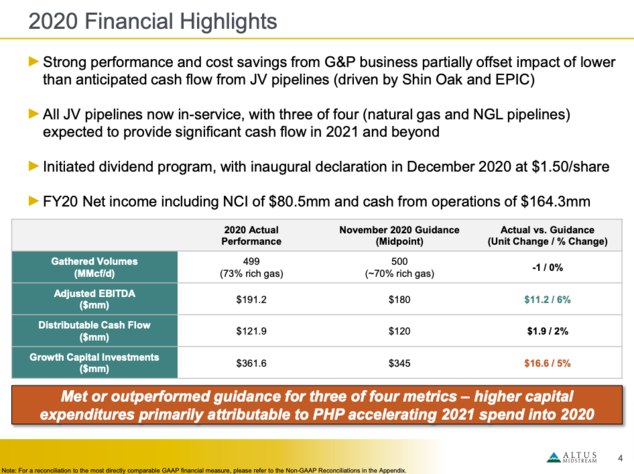

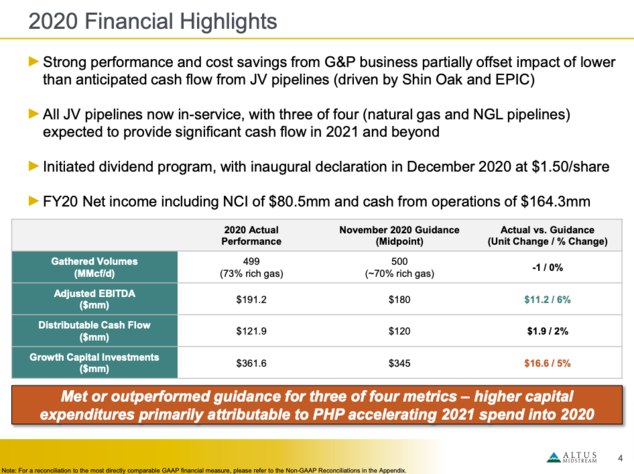

Notes from a same-day replay. Shares closed up 0.30% on a bigger down day for the broader market and sector.

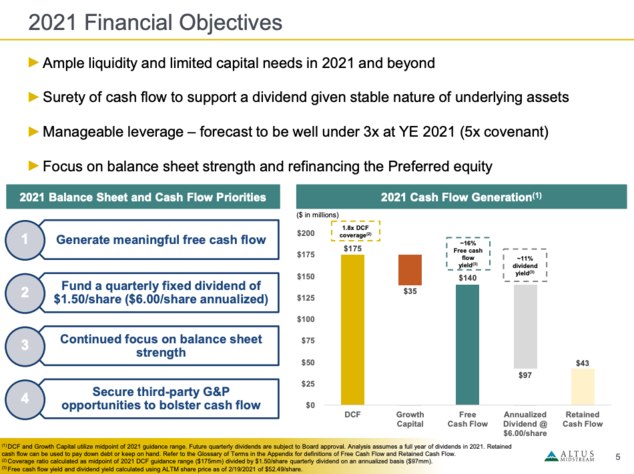

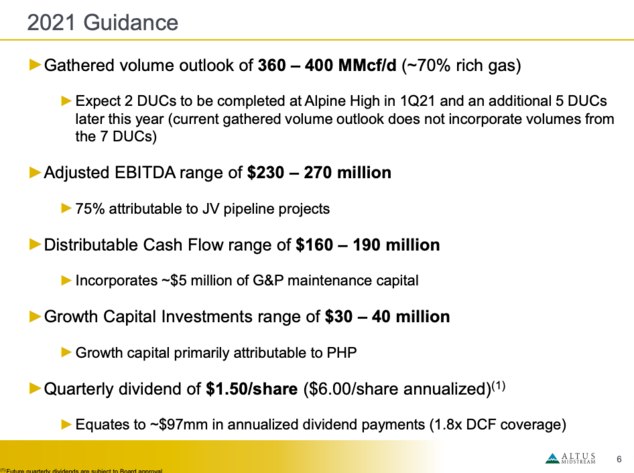

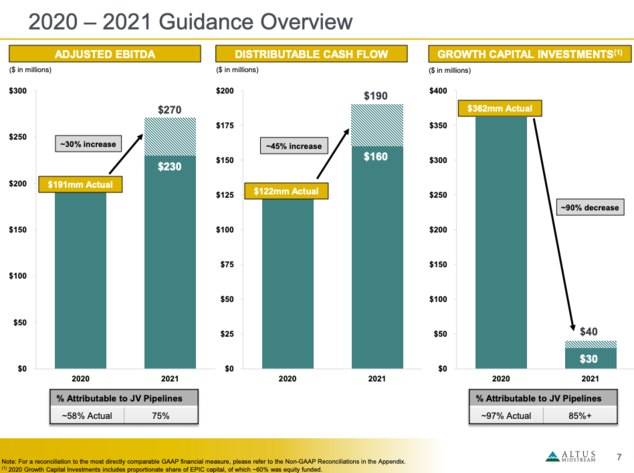

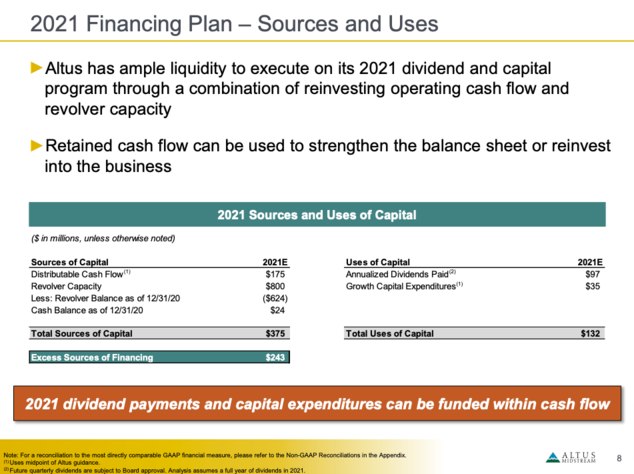

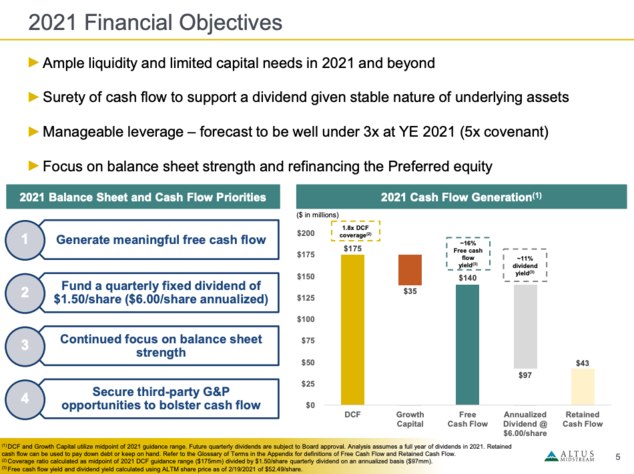

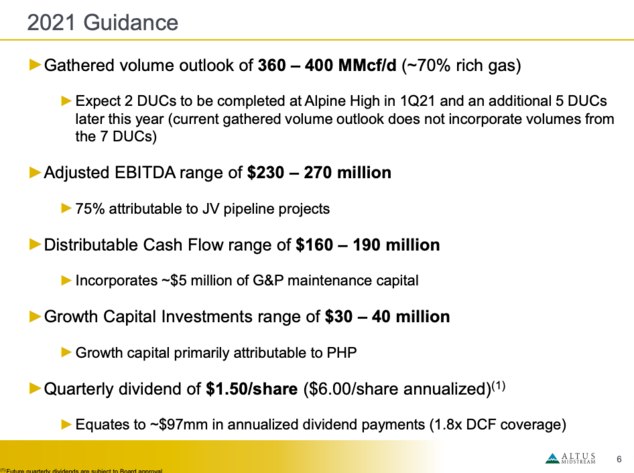

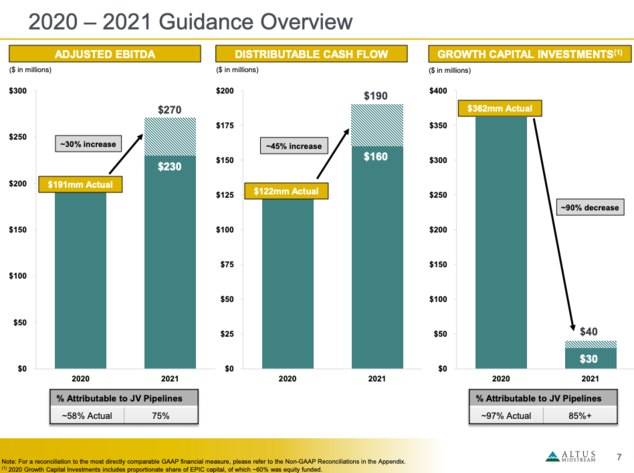

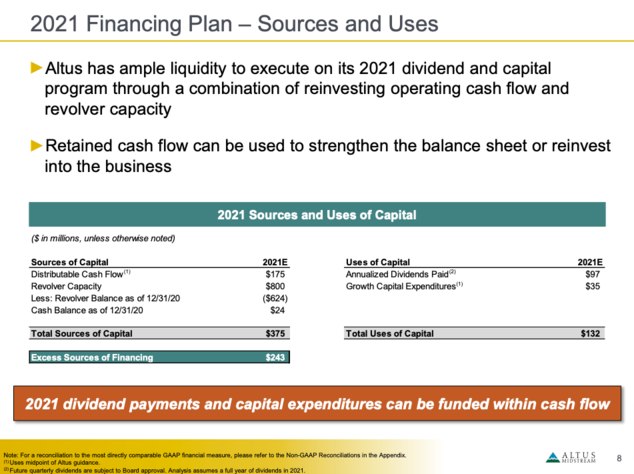

Release was here, first look was here, full preso here. Select slides below.

Call Notes...

CEO: Weathered storm, all key mets at or above mid-point. Raised in July and November.

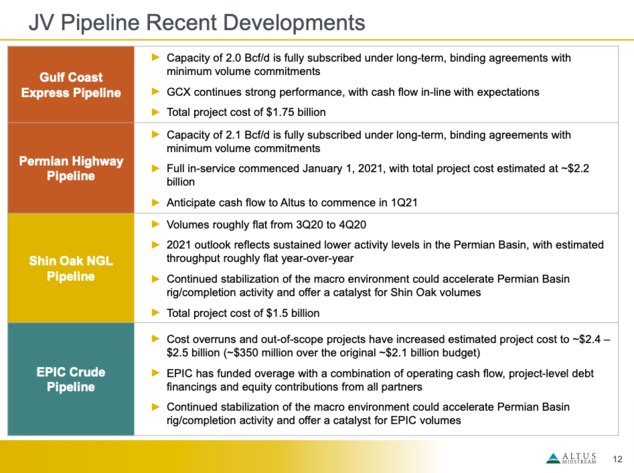

Growth capex higher than guide due to PHP pull-forward.

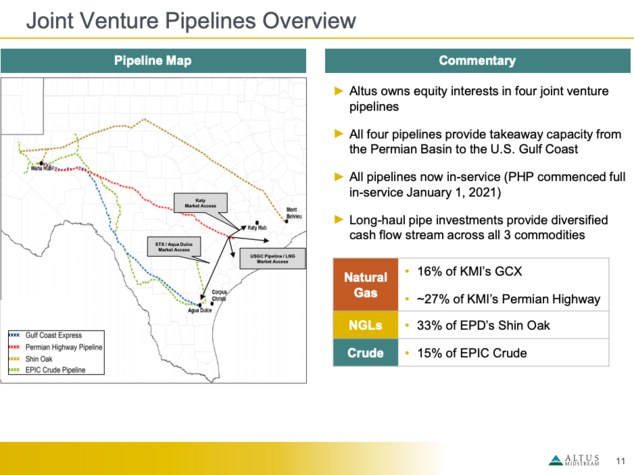

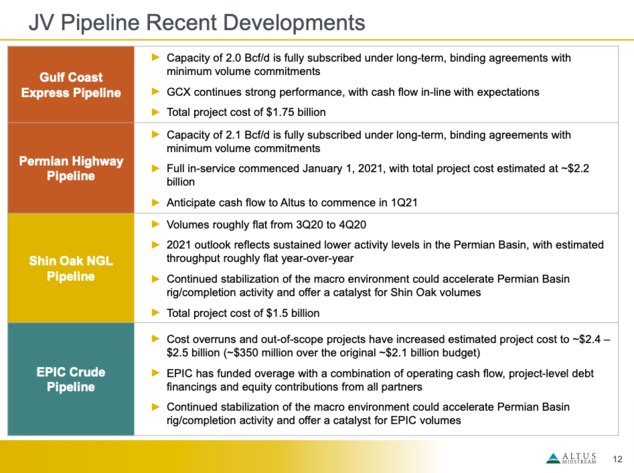

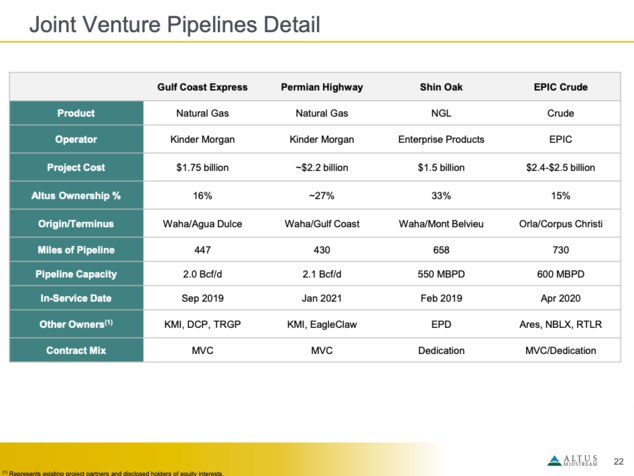

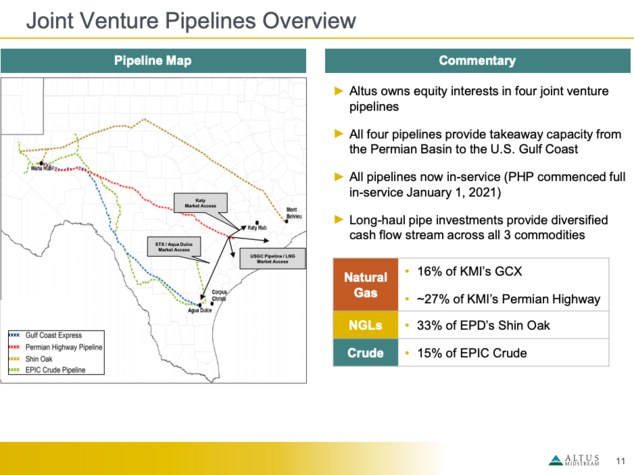

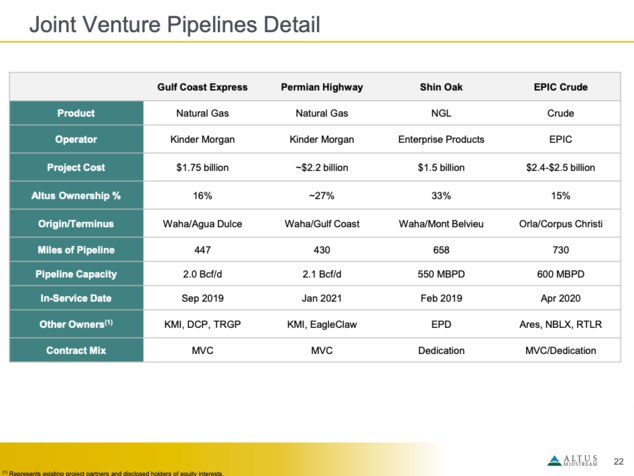

PHP start-up and JV contribs = $6 annual divvy. All 4 pipes in service, GCX and PHP full, long-term.

Shin Oak and EPIC impacted by reduced drilling in Delaware. Rig count there 116 down from year ago, upside as activity increases.

Looking for 3rd party biz, opex down by 1/3 YOY. Some cost savings still to capture. No injuries among our guys. Absences due to COVID over holidays, but none among employees.

Focused on op efficiency and environ footprint.

Number of projects with ESG...vapor recovery on tanks, compressed air on pneumatics, nat gas leak detection, test 2x required, less methane in blowdown. Using electric compression, too. Back-up gens for Diamond Cryo. Less flaring, light pollution being addressed near observatory, too.

On Q4...earnings boost from PHP, offset lower G&P vols from reduced drilling. Some success on new revenue streams...processing off-spec condensate vols more in Q4, new compression outside Alpine High, load shedding at cryo plant.

Positive momentum, vaccines coming, renewed interest in drilling and completions.

Focus this year is capture of 3rd party volumes for G&P, including expanding biz with APA outside Alpine High. Deals to optimize underutilized assets - divestment or redeployment.

ESG - to reduce flaring 10%, blowdowns 30%, protecting divvy while looking at refi the preferreds.

All 4 pipes in service full year. Negligible growth capex after Q1.

CFO: hitting deets from release, EBITDA and growth capex...

Walking thru accounting of derivs, volumes, see release.

Guidance (as per release): consistent with update in November. E&Ps saying capital will flex, we will adjust outlook, too. Pricing improved, activity up, but priority is op discipline and returning cap versus production growth. May impact our 3rd party biz capture in G&P, less urgency.

JV pipe biz: conservative on util of Shin Oak and EPIC...no 3rd party biz or increase in NGLs, both would be upside (more on this later).

Alpine High - 5 more ducs.

Still assessing impacts of freeze last week, to update in May.

Minimal maint capex on JV pipes, new, $5M on G&P - in guidance.

Plenty of liquidity $800M revolver, good til '23.

Re-fi of preferreds...multiple options, will protect divvy and balance sheet.

Seeing add'l completions at Alpine High, upside from 3rd party.

Going to Q&A at minute 15.

Q1. Credit Suisse. Gas prices up, 3rd party opps improving?

A. Very positive about it, should create some opps. Producers being careful not to get out over skiis, but positive prospects in and around Alpine High. Would come later in year, not right now, having some conversations. Encouraged by completion of 2 DUCs APA mentioned this morning...5 more later this year.

Better year ahead of us in terms of 3rd party prospects. Found a few last year even though tough, expect to do even better this year. Price on oil, gas and assoc gas should help.

Q2. Preferred way to refi preferreds?

A. Too early, have some retained cash flow at midpoint of DCF guidance - assumes no asset sales...ended last yr with $25M of cash on BS, so have cash, looking at all sorts of alts but early.

Perfect timing on crossover of MOIC and IRR is late '21 early '22 so have time but good to see cap markets and high yield opening back up and at attractive terms.

Focus to keep manageable leverage and protect dividend.

Q3. US Capital Advisors. 7 ducs that Apache talked about - any more? Active rigs anytime soon in Alpine High?

A. Those 7 are ones will do in 2021, have others, will see if will go after others in future. Depends on economics. APA commented this morning that first 2 ducs performing very well, may have opp to bring in additional capital to drill more in Alpine High, will see. Positive signal.

Q4. Two liquids pipes (so Shin Oak and EPIC) - if SO flat yoy, what does mean for util, how much could add?

A. Kinda hard to say, not providing that. Assuming yoy flat volumes, barring any material impact from freeze off. At $60 to $65 oil, will monitor, is some upside, will continue to monitor.

Another impact for NGL pipes is ethane rejections...gas up, C3+ up, ethane lagging a bit, will counterbalance growth from y-grade. Little rejection last year. YOY flat is appropriate for today, but will update in a few months. Could be upside to that number.

Q5. EPIC crude term loan...timeline on getting distros from there?

A. Timeline pushed out after COVID. Can't speak too much yet, no covvie issues, 7 year term from 2019, plenty of runway and is public so can see where marked. Not too onerous, but any near term distros to equity pushed out for some time.

Q6. Overall leverage of EPIC?

A. Let me check if we can even speak to that, not sure how much we should speak publicly to that.

Call done minute 26. CEO closing thoughts...enter '21 with nice momentum...no ALTM assets operate on federal lands. Need a resilient and reliable energy supply. Will generate FCF all year, will return cap to shareholders, divvy on the way next month.

Good call, good tone. Altus was a bright spot in an ugly tape today.

More importantly, though, becoming clearer that they're sandbagging that '21 guidance. Say that cuz they will tap 7 ducs in Alpine High this year (not in guide), both EPIC and Shin Oak bought should contribute considerably more this year that discussed so far (note the phrase in both of those slides..."forward outlook may benefit from an improved macro environment")...and current guidance still assumes PHP will start up later in Q1...but actually already started up on January 1.

To be clear - conservative is good, from their perspective, given what they went thru prior to us getting involved...but seems like good odds we see a bump up in guidance in conjunction with Q1 report.

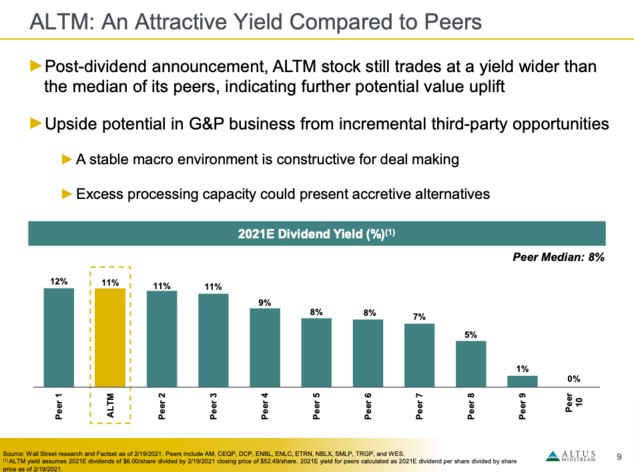

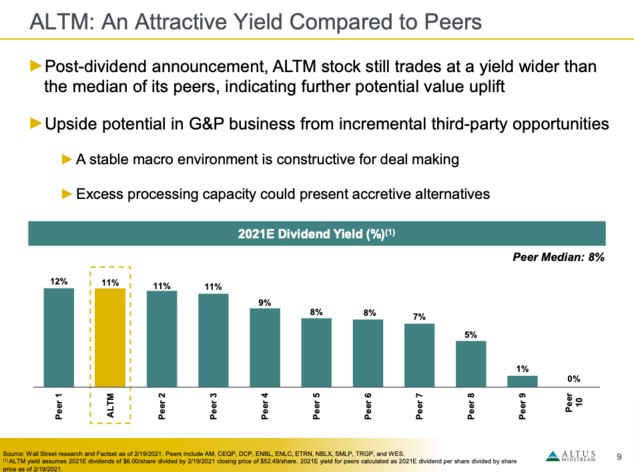

And though we've seen a nice run in our shares since last fall...still a ways to go, IMHO.

As back-of-the-envelope as possible...$190M in distributable free cash flow (high end of range) would be $11.69/share. Put a still-too-cheap FCF multiple of 10x on that (call it rough mix of low multiple on G&P assets, high on new pipes, fully subscribed for 10 years, nice rates) and ya get $117 per share. Before adding (a) third party, (b) actual full year PHP cash flows, (c) NGL uplift from Shin Oak and (d) more free cash flow from EPIC, too. Eventually. And never mind any other deals/pipes...and/or seeing Alpine High drilling perhaps fire back up at scale some day. To be sure, kinda slim chance on that last one - at least while still owned by APA - but even those chances did increase a bit further from zero given some of those comments on the call there...so not impossible, eh? I mean, just this week we landed a little go-cart on Mars, people.

Also is now a pretty clear path here to take out those high-cost preferreds.

And in the meantime, we get paid 54% a year to wait on our shares. While they throw off plenty of free cash...and run the biz for value accretion at their major shareholder (unowned $APA)...and little ole us, too, I suppose...meaning that cash is going directly to debt paydown, not growth.

Een nuttin', mon!

<end bad Bahamian accent>

Select slides:

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

February 25, 2021Peak earnings season for Tarpon continues. Three calls yesterday, two more calls today. Notes and slides on the company threads.

Cale

February 25, 2021Peak earnings season for Tarpon continues. Three calls yesterday, two more calls today. Notes and slides on the company threads.

WTI flat at $63-low this morning, nat gas up 1.15% to $2.83.

And on the geopolitical front, would note that the new U.S. Administration is expected to release a report later today pinning the 2018 killing of journalist Khashoggi on the Saudi crown prince MBS. Unclear what may follow that - if anything, from either side - but in the meantime, may be a signal that the tweets, er, considerable influence the U.S. was exerting on Saudi regarding global oil prices the last few years may soon be a thing of the past. Read into that what you may.

Thursday assorted links:

1. Reuters: OPEC+ considers modest boost to production from April.

Short version of my thoughts on the March 4th OPEC meeting:

Russia and Saudi clearly have different agendas, but I don't expect a big clash next week.

Now...drama? Of course, will be some. I mean - it's OPEC+, whatarewetalkingabout.

Still, my expectation is the outcome will be similar to January: they both get what they want...while they continue to stay coordinated. Specifically, odds seem highest to me that Saudi keeps its existing unilateral cut of 1M bopd for another month, and Russia gets the nod to slowly lift production a bit more.

Sooooo....outcome will IMHO most likely be continued cooperation...with continued restraint...and controlled supply. Gotta keep that backwardation - although the longer-dated oil prices are still too low here. Even if we get a little pullback in the front month. But that's probably another post.

And with regards to Tarpon: ideally, am putting that cash to work over the next week or two. Stay tuned.

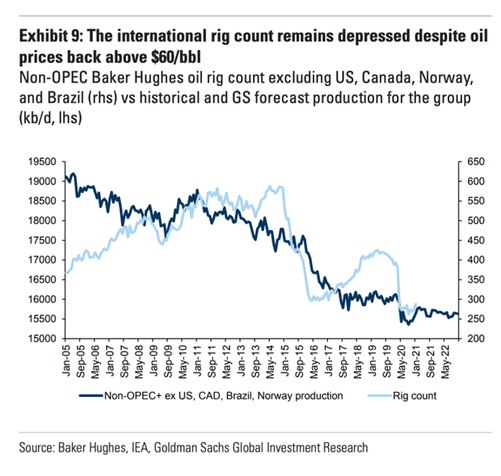

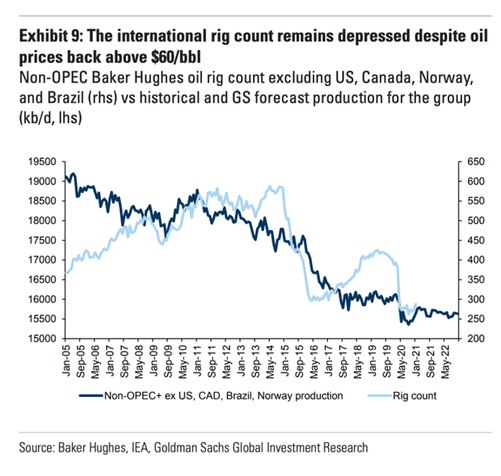

2. Rig counts:

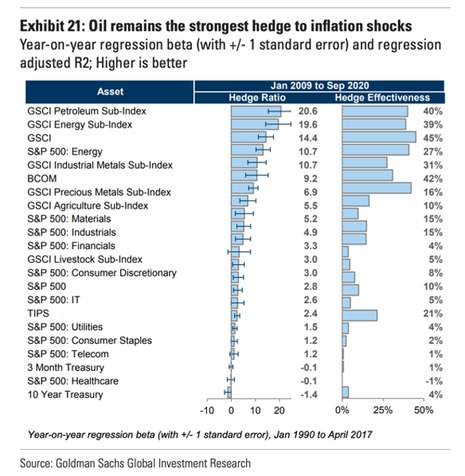

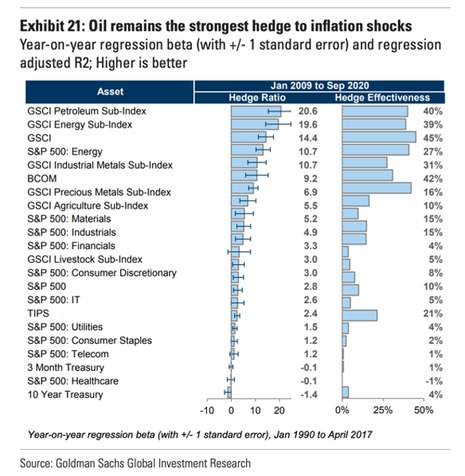

3. Oil as an inflation hedge:

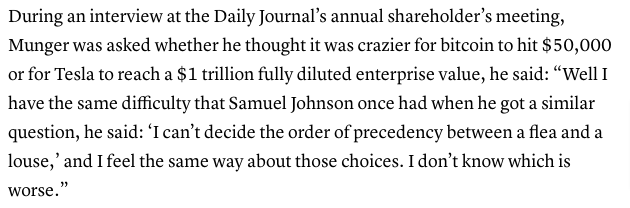

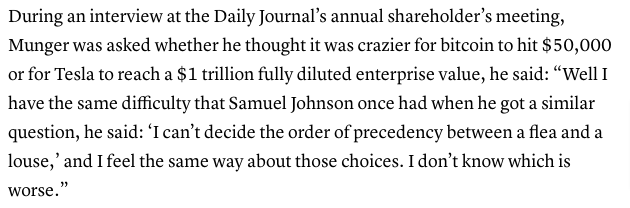

4. Charlie Munger doesn’t know what’s worse: Tesla at $1 trillion or bitcoin at $50,000

And is 97 too old to be a TikTok star??

More in a bit on the private boards.

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

February 24, 2021WTI up 1.25% to $62.44. Nat gas off 0.80% to $2.86.

Cale

February 24, 2021WTI up 1.25% to $62.44. Nat gas off 0.80% to $2.86.

Peak-earnings-call week for Tarpon continues.

In the meantime, WSJ with a good primer related to some recent discussion on here:

Why Higher Rates Are Hammering Big Tech

Rising long-term Treasury yields ultimately might not pose much of a problem for most stocks. But the bout of indigestion that higher yields are already giving to some of the past year’s biggest winners—shares of companies including Amazon.com, Apple, Tesla and Microsoft — could prove more lasting.

Some of that is because these companies’ steep valuations make them vulnerable to rising yields. But it also stems from how, even as the Covid-19 pandemic wreaked havoc, those stocks did so well.

Wednesday Assorted Links:

1. BBG: Whispers of $100 Oil Return as Crude Shakes Off Covid’s Clasp

While oil’s dizzying collapse is still fresh for many traders, rumblings are starting to emerge that by the end of next year prices could once again top $100 a barrel.

2. BBG: Socar Trading Head Expects Oil to Hit $80 a Barrel This Year.

I mean, I've never heard of 'Socar Trading,' either - but they're really confirming my priors here, so I'm all for it. And in my own defense - I have been to Baku, which maybe makes this link legit...?

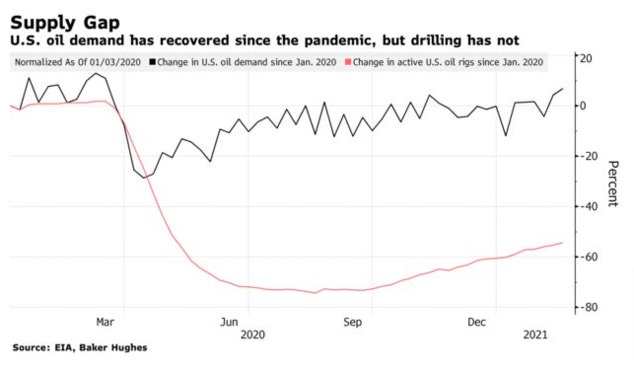

Oil prices will hit $80 a barrel this year as demand comes roaring back and producers won’t be able to immediately respond with sufficient supply, Socar Trading SA said, joining a chorus of bullish calls on the market.

Hayal Ahmadzada, Socar’s chief trading officer, said the glut of excess oil stocks that built up in 2020 in response to the pandemic will be fully drawn down by the summer. At the same time, soaring prices for steel used in pipes, wells and fittings as well as the high cost of capital for producers will crimp a meaningful supply response by an already hobbled industry even as demand returns.

“I will not be surprised if we see $80 a barrel in summer or before year-end and above $100 a barrel in the next 18 to 24 months,” Ahmadzada said in an interview from Baku, Azerbaijan.

3. Platts: Global oil demand likely to rebound to pre-COVID levels by end-2021: analysts

4. Energy Intel: Shale Giants Hold the Line Despite $60 Oil

Benchmark US crude prices have jumped more than 25% since the start of the year. But the return of $60 oil isn't tempting the country's largest shale producers to loosen the purse strings.

Management teams have used their recent earnings conference calls to repeatedly assure investors they will remain steadfast in prioritizing capital discipline over growth, with many maintaining guidance put forward when oil was stuck in the $40s.

"If commodity prices surprise to the upside, we will remain disciplined and won't chase growth. If the recent commodity price strength persists, we will not raise our capital spending … we will simply generate even more free cash flow," said Marathon Oil CEO Lee Tillman, capturing the sentiment echoed by others.

5. Today's "supercycle" sighting:

A New Commodities Supercycle Is Looming

Kinda derivative, but I'll allow it.

6. And here you go @Ryan Y:

Will ARK Invest Blow Up?. Not endorsing that kinda fate, you understand...

Three more Q4 calls this morning, more on today's Company News thread.

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services.

Active Discussions

-

Such an Exciting and Opportunity-Filled Time to be an Infrastructure Investor JRo,

-

United Rentals Acquiring H&E Equipment Services in ALL CASH Deal JRo,

-

"Generational" Growth Opportunity for Infrastructure According to Goldman Sachs JRo,

-

“$2 trillion in hyperscaler cloud capex could be deployed in the next five years” JRo,

-

Excellent letter from Samantha McLemore (Bill Miller’s #2 for 20 years) Cale,

- Terms of Service

- Useful Hints and Tips

- Sign In

- © 2025 Spoke Fund® Boards