-

Cale

June 14, 2021Brent and WTI backwardation widened significantly over the weekend. The TSA also reported more than 2 million passengers were screened in U.S. airports - the highest level since the pandemic began in March 2020. That's still 26% lower than the same period in 2019...but 1.5M more than in 2020.

Cale

June 14, 2021Brent and WTI backwardation widened significantly over the weekend. The TSA also reported more than 2 million passengers were screened in U.S. airports - the highest level since the pandemic began in March 2020. That's still 26% lower than the same period in 2019...but 1.5M more than in 2020.

So that surge in demand is coming.

In Iran, the conclusion that these JCPOA negotiations were entered into in bad faith all along...i.e. to bolster the hardliner candidate in Iranian elections...appears to be growing more obvious. To me, anyway.

WTI up to $71.56 this morning, nat gas down 0.2% to $3.29.

Monday assorted links

1. BBG: G-7 Drops Aim to Shift New Car Sales Away from Oil By 2030

Group of Seven nations backed away from plans to set a target for making sure most new cars sold are greener vehicles, instead pledging only speed up efforts to move away from combustion engines.

In the final communique Sunday, the bloc include an autos section that was far more modest than earlier versions being discussed. It pledged to do more to electrify the transport sector but didn’t set firm target dates.

2. BBG: Iran Warns Time Running Out to Secure Revival of Nuclear Deal

President Hassan Rouhani -- who negotiated the original deal in 2015 -- is due to leave office in August after serving two terms. He is widely expected to be replaced by Ebrahim Raisi, a cleric who is hostile to engaging with the U.S. He’s said he will continue backing the deal but will make it a more “marginal issue” for Iran if he’s voted into office.

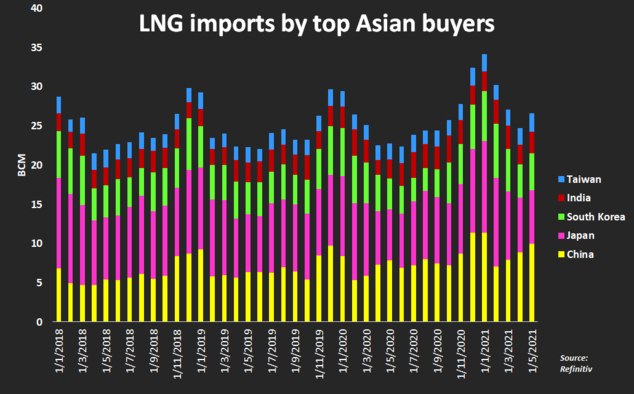

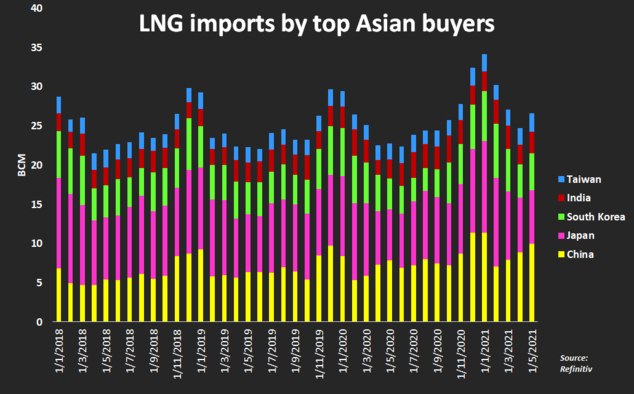

3. Reuters: LNG market poised for buoyant recovery with demand growing across Asia

4. WSJ (from Friday): House Bills Seek to Break Up Amazon and Other Big Tech Companies

If the bills become law—a prospect that faces significant hurdles—they could substantially alter the most richly valued companies in America and reshape an industry that has extended its impact into nearly every facet of work and life.

5. BBG: Jimmy Buffett Has Just What New York Needs Right Now: A $370 Million Monument to Frozen Drinks

You're welcome, NYC.

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

June 7, 2021Monday assorted links

Cale

June 7, 2021Monday assorted links

1. WSJ: Options Traders Bet on Return of $100 Oil

“Everyone’s been looking at it,” Adam Webb, chief investment officer of trading firm Blue Creek Capital Management LLC, said of $100 call options for oil delivered in December 2022. “It’s a no-brainer.”

2. BBG: Rosneft Warns of ‘Severe’ Oil Shortage Amid Hasty Energy Shift

Russian oil giant Rosneft PJSC warned of an impending shortfall in supply as global producers increasingly channel funds into a “hasty” energy transition.

“The world risks a severe deficit of oil and gas,” Rosneft Chief Executive Officer Igor Sechin said Saturday at the St. Petersburg International Economic Forum. “The world consumes oil, but isn’t ready to invest in it.”

His comments echo those of Russian Deputy Prime Minister Alexander Novak, who this week rejected calls for a rapid shift away from oil and gas, saying starving the industry of investment would harm the global economy. But fossil-fuel producers are facing mounting pressure to switch to cleaner forms of energy as governments step up efforts to prevent damaging climate change.

“It shouldn’t be about rejecting oil, but about rejecting crude from environmentally unfriendly projects,” Sechin said on an energy panel that also included BP Plc CEO Bernard Looney and Glencore Plc boss Ivan Glasenberg. “Oil consumption will continue to grow despite a relative drop in its share in the global energy mix.”

3. RBN: How COVID-19 Reshaped the Future of North American LNG Projects

4. Reuters: Market for U.S. oil acreage booms along with crude price recovery

A recovery in the price of oil to more than two-year highs is offering a long-awaited opening to companies and private equity firms to shed unloved assets in the U.S. oil patch.

5. 15 State Treasurers Warn They Will Pull Assets From Banks That Obstruct the Fossil Fuel Industry

Fifteen Republican State Treasurers sent a warning that they will pull assets from financial institutions if they give in to Federal pressure to de-carbonize and “refuse to lend to or invest in” the fossil fuel and coal industry.

The letter, led by West Virginia Treasurer Riley Moore, is directed at Special Presidential Envoy for Climate John Kerry. It expresses concerns over reports that Kerry and other members of the Biden administration have been “privately pressuring” U.S. banks to stifle the fossil fuel industry.

“We are writing today to express our deep concern with recent reports that you, and other members of the Biden Administration, are privately pressuring U.S. banks and financial institutions to refuse to lend to or invest in coal, oil, and natural gas companies, as part of a misguided strategy to eliminate the fossil fuel industry in our country,” the letter reads.

The State Treasurers sent a plain message to financial institutions, telling them not to submit to the present administration’s coercion to deny investment and lending for the natural resources.

Hat tip to Adrian for that link.

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

June 1, 2021OPEC+ meeting today. Should be a rubber stamp, and ministers sound confident oil market will be able to absorb gradual increases in production. Group also does not expect Iran's output hike to hinder their plans. Official statement out a bit later today. Meantime, IEA a bit less subtle, saying oil prices face upward pressure unless OPEC+ boosts output.

Cale

June 1, 2021OPEC+ meeting today. Should be a rubber stamp, and ministers sound confident oil market will be able to absorb gradual increases in production. Group also does not expect Iran's output hike to hinder their plans. Official statement out a bit later today. Meantime, IEA a bit less subtle, saying oil prices face upward pressure unless OPEC+ boosts output.

WTI up 2.7% to $68, nat gas up 3.25% to $3.08.

Meanwhile, JCPOA negotiations get more complicated as the Iranians appear to punt on further progress until after the June election, and the International Atomic Energy Agency casts doubt on their willingness to take it seriously.

Monday assorted links

1. Reuters: Unlike IEA, Rystad Energy sees need for hundreds of new oilfields

2. BBG Video: Reliance on Fossil Fuels Will Last 10-15 Years: Citi's Morse

3. Steve LeVine: What if consumers decide that EVs aren’t better than combustion?

4. BBG: This Time Is Different: Outside OPEC+, Oil Growth Stalls

“This time is different” may be the most dangerous words in business: billions of dollars have been lost betting that history won’t repeat itself. And yet now, in the oil world, it looks like this time really will be.

For the first time in decades, oil companies aren’t rushing to increase production to chase rising oil prices as Brent crude approaches $70. Even in the Permian, the prolific shale basin at the center of the U.S. energy boom, drillers are resisting their traditional boom-and-bust cycle of spending.

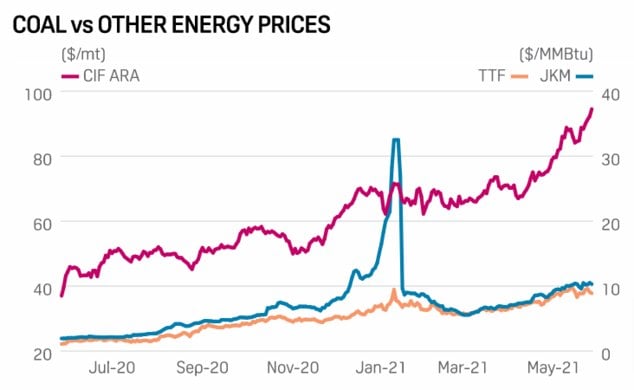

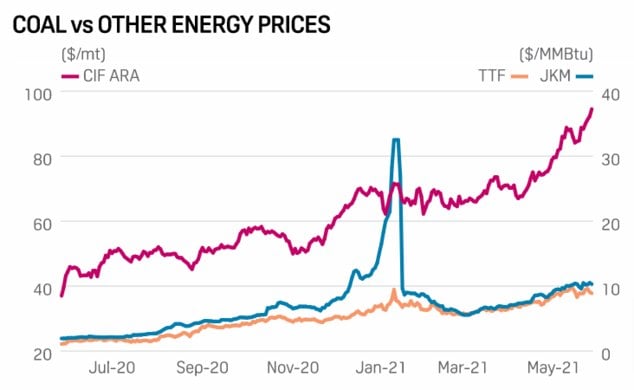

5. Platts: Coal rally continues amid concerns on supply availability to meet demand

6. FT: U.S. regulators signal bigger role in cryptocurrencies market

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

May 24, 2021Monday assorted links

Cale

May 24, 2021Monday assorted links

1. From Goldman's latest report, The path to higher oil prices:

With growing evidence of the demand rebound, and imminent clarification on the likelihood of an Iranian return, we now see a clearer path for the next leg higher in oil prices, with the sell-off offering opportunities to position for the rally to $80/bbl.

Will post the full PDF on the private boards.

2. FT: Member countries push back against IEA’s net zero road map

Japan and Australia have disputed the findings of the International Energy Agency’s report on reaching net zero emissions by 2050, indicating they will continue fossil fuel investment despite the watchdog’s advice.

The push back from member countries — traditionally big fossil fuel consumers — and global energy producers, highlights the controversy surrounding the IEA’s recommendations which include halting fossil fuel exploration and spending on new projects.

While the IEA has said there is a need to continue investing in already discovered deposits and existing projects, critics say the body does not adequately acknowledge the risks to future energy security, and fails to provide a backstop should the world not manage to create adequate low-carbon alternatives to replace fossil fuels.

3. India: New Delhi to relax lockdown as COVID cases decline

India’s capital New Delhi will start relaxing its strict coronavirus lockdown next week if its new cases continue to drop.

The South Asian country on Sunday reported 240,842 new infections nationwide over 24 hours – the lowest daily number in more than a month – and 3,741 deaths.

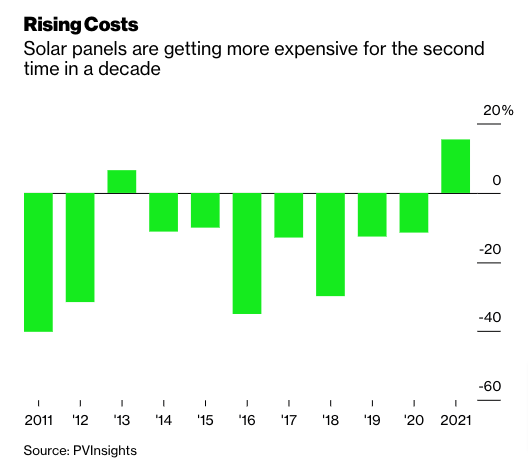

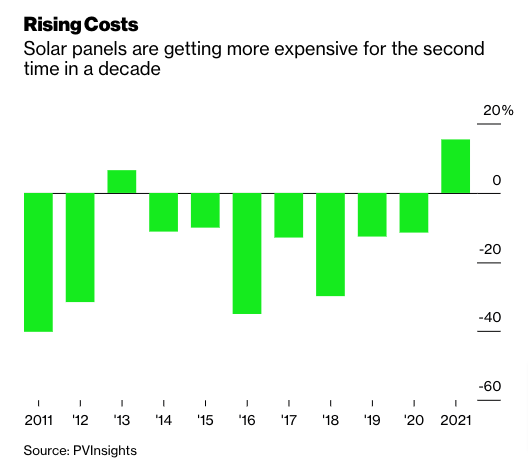

4. BBG: Solar Power's Decade of Falling Costs Is Thrown Into Reverse

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services.

Active Discussions

-

Such an Exciting and Opportunity-Filled Time to be an Infrastructure Investor JRo,

-

United Rentals Acquiring H&E Equipment Services in ALL CASH Deal JRo,

-

"Generational" Growth Opportunity for Infrastructure According to Goldman Sachs JRo,

-

“$2 trillion in hyperscaler cloud capex could be deployed in the next five years” JRo,

-

Excellent letter from Samantha McLemore (Bill Miller’s #2 for 20 years) Cale,

- Terms of Service

- Useful Hints and Tips

- Sign In

- © 2025 Spoke Fund® Boards