-

Cale

March 16, 2021As a heads-up to new board visitors: there will limited public posts this week while I knock out a few things in the post-earnings-season lull. Still tracking company news this week on the private boards for IIM investors, though am expecting a quiet week there, too.

Cale

March 16, 2021As a heads-up to new board visitors: there will limited public posts this week while I knock out a few things in the post-earnings-season lull. Still tracking company news this week on the private boards for IIM investors, though am expecting a quiet week there, too.

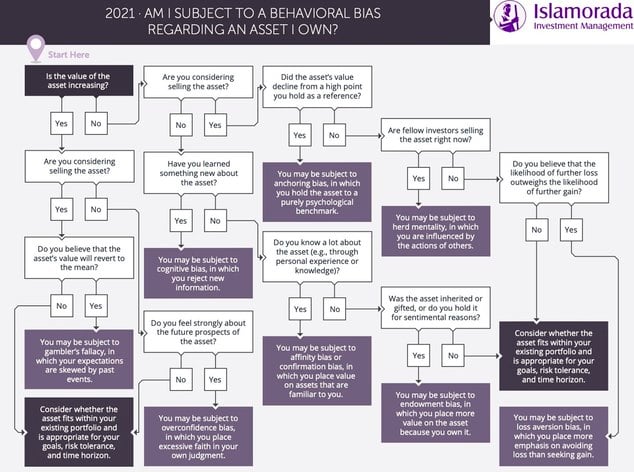

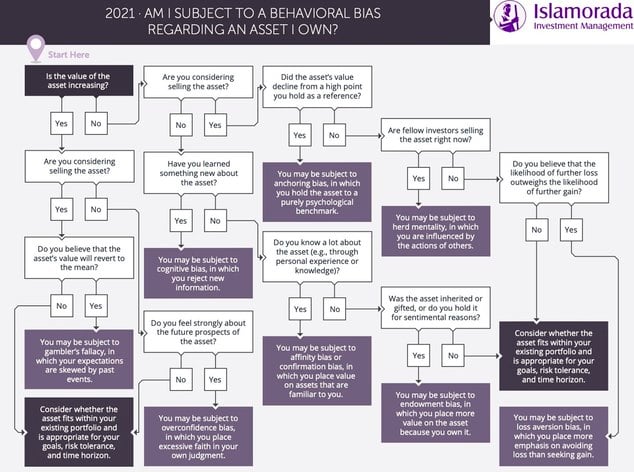

In the meantime, good little flowchart here for both board guests and investors...

Am I Subject To A Behavioral Bias Regarding An Asset I Own?

Snapshot (click to embiggen):

There is one obvious rectangle missing, of course. The one that should say:

"Don't even think about selling, Hoss."

Will try to squeeze that box into the next version. -

Cale

March 12, 2021Government bond yields up, tech stocks down this morning.

Cale

March 12, 2021Government bond yields up, tech stocks down this morning.

WTI down 0.4%, nat gas up 0.6%.

Reports overnight of a new front in the conflict between Israel and Iran, as Israel has targeted at least a dozen vessels carrying Iranian oil. WSJ with more here.

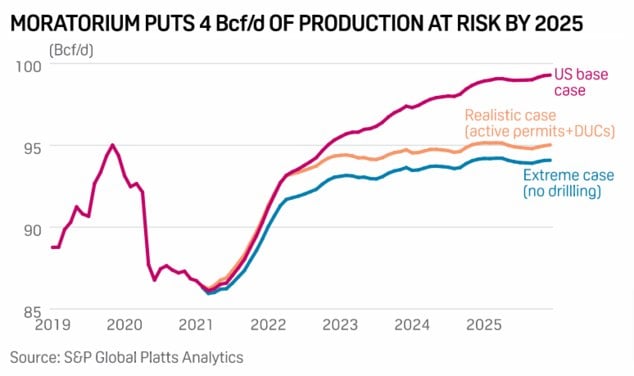

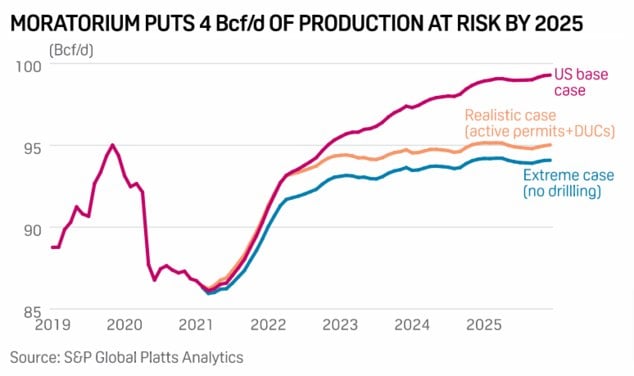

Argus noting a surge in U.S. drilling permit approvals the last two weeks, and, as expected, New Mexico is seeking an exemption from the new Administration's oil and gas leasing pause.

All of which IMHO is an excellent segue into this FT op-ed:

Want a greener world? Don’t dump oil stocks

The transition to cleaner energy is under way. But it’s going to take several decades. In the meantime we need traditional sources of energy. Shouting at oil doesn’t change that. You could even call it, as the UK pensions minister did this week, “reverse greenwashing” — something that might make you look good but that does nothing to fix the real problem.

The rationality is strong with this one.

Friday assorted links

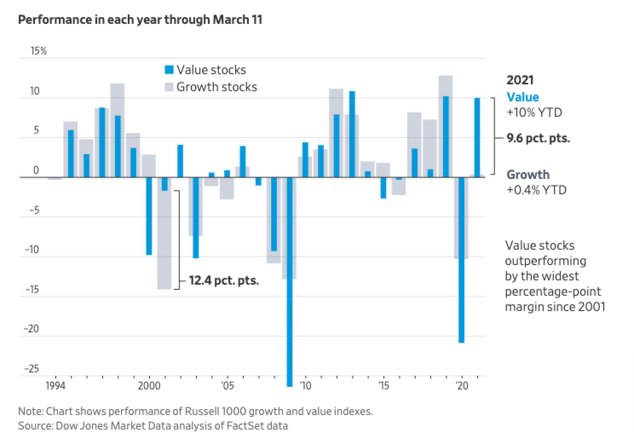

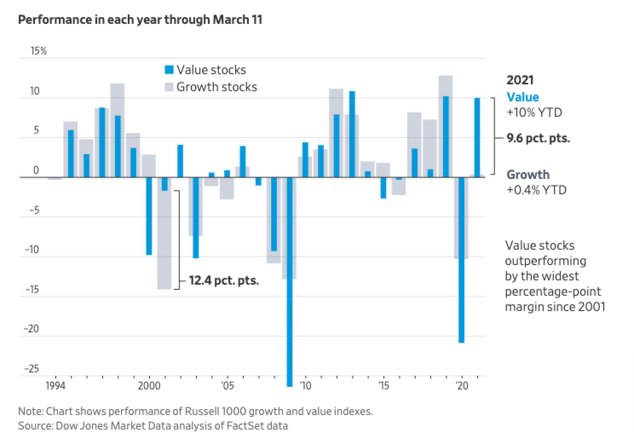

1. WSJ: Value Investors Finally Have Reason to Celebrate - for Now

Value stocks are beating growth stocks by the widest margin in two decades, the latest sign that investors expect the next year to bring a powerful economic rebound.

Cannot believe they said that out loud. Was fun while it lasted, though, right??

2. Today's 'supercycle' sighting:

The Upcoming Commodities Supercycle.

The next bull market isn’t in Tech.

Give that guy a Substack.

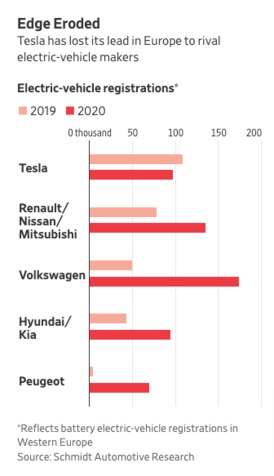

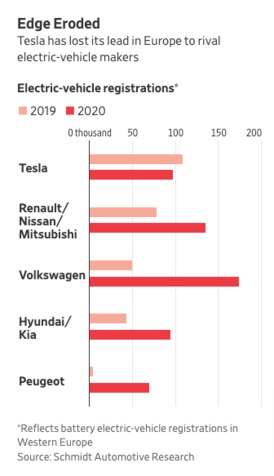

3. WSJ: Tesla Faces New Reality of Tough Competition

Customers in Western Europe registered roughly 98,000 Teslas in 2020, down about 11% from 2019, while overall registrations of all-electric vehicles more than doubled, according to Schmidt Automotive Research. Tesla’s share of the market fell to around 13% in 2020 from roughly 31% a year earlier.

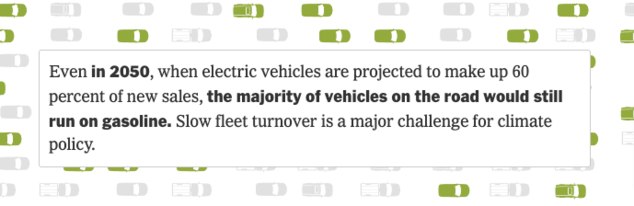

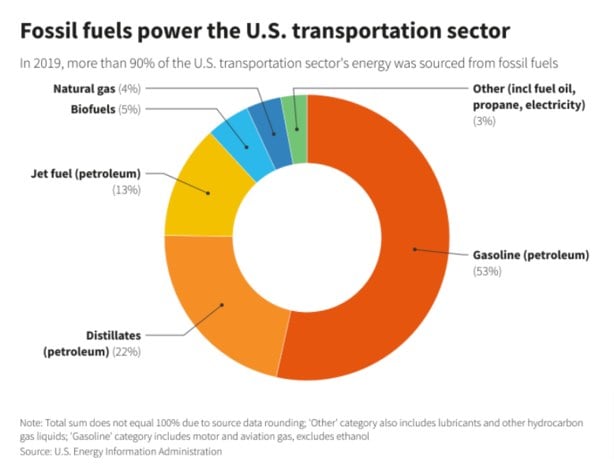

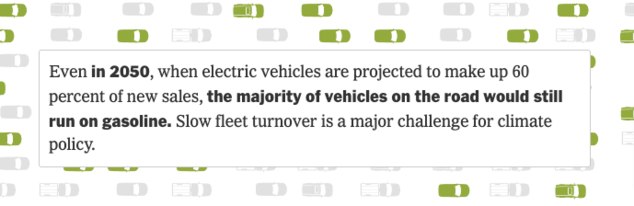

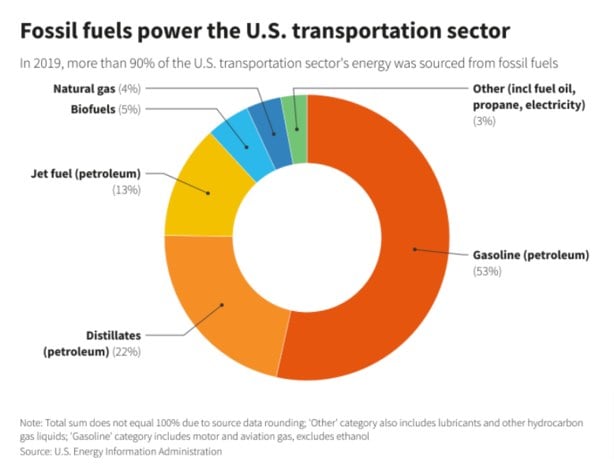

4. NYT: Electric Cars Are Coming. How Long Until They Rule the Road?

Around the world, governments and automakers are focused on selling newer, cleaner electric vehicles as a key solution to climate change. Yet it could take years, if not decades, before the technology has a drastic effect on greenhouse gas emissions.

One reason for that? It will take a long time for all the existing gasoline-powered vehicles on the road to reach the end of their life spans.

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

March 11, 2021WTI up 1.30% to $65.28, nat gas down 0.3%, S&P 500 futures green.

Cale

March 11, 2021WTI up 1.30% to $65.28, nat gas down 0.3%, S&P 500 futures green.

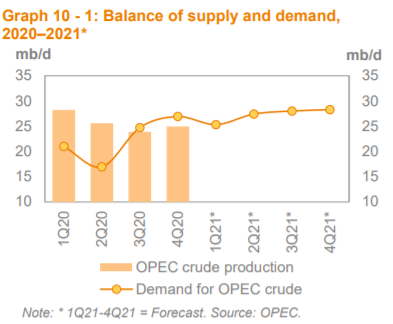

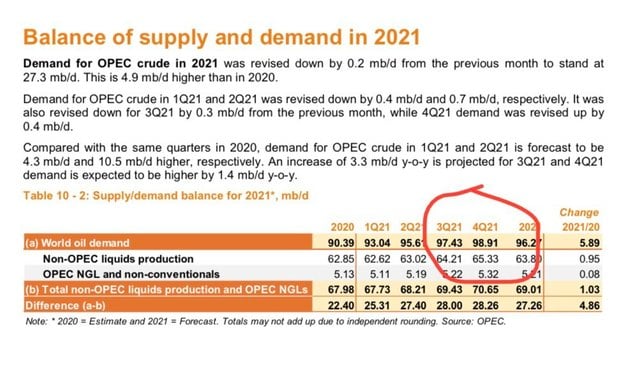

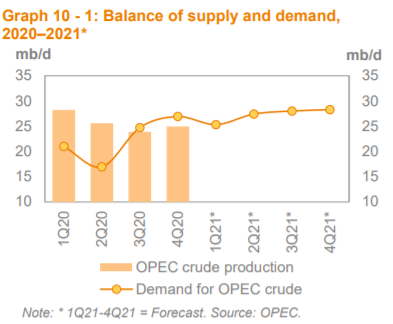

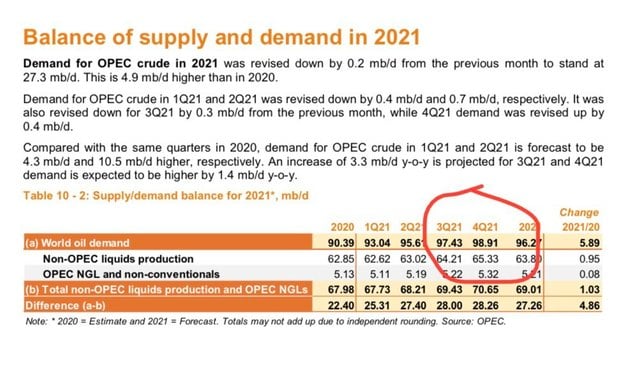

OPEC monthly report out. Initial take: confirming a recovery in global oil demand recovery will occur in the second half of 2021. Snap...

Deets...

Still reading.

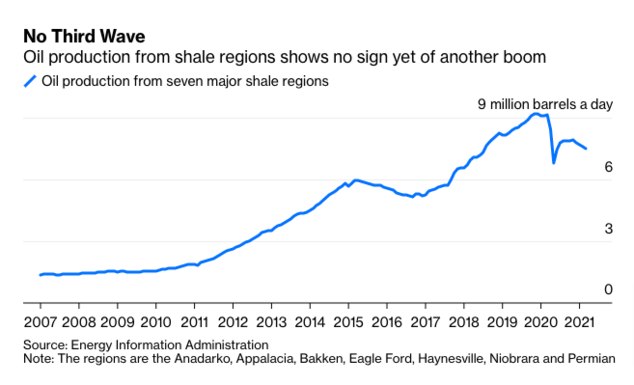

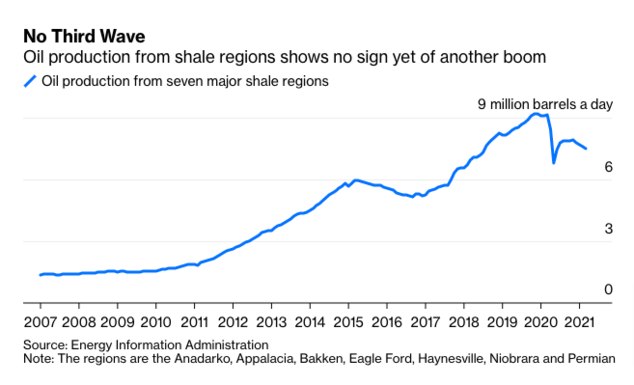

In the shale patch, also noting that the 60-day federal moratorium on permitting ends in five days (by my count) - which may explain a few policy proposal headlines out of D.C. this week. More below.

Also have the final Q4 call in our group this morning. Notes to follow on the private boards.

Thursday assorted links

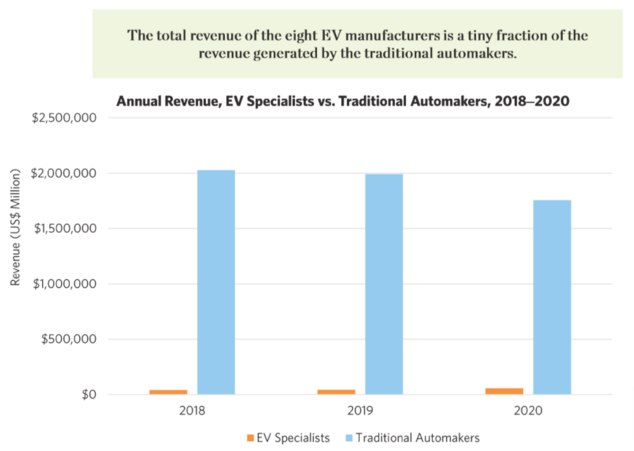

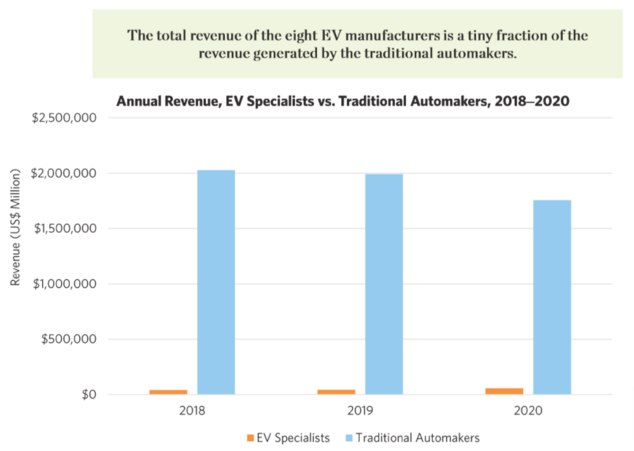

1. Big Market Delusion: Electric Vehicles

In our view, today’s electric vehicle industry is a classic example of the big market delusion. The EV phenomenon will not change the fact that the auto industry will remain highly competitive and capital intensive, and not every company can be a winner. Further, it remains unclear how simply switching the means of auto propulsion will make the entire light EV market more profitable, an assumption the market is now currently making. We suspect that as EV competition heats up, many companies will fail, as was the case in previous industry booms—whether autos, airlines, or technology—and with time the total value of the industry will recede to more reasonable levels.

2. Pierre Andurand’s hedge fund rides commodity rally for early 2021 gain

Hedge fund manager Pierre Andurand has emerged as one of the early winners from the big commodity market rebound, drumming up returns of almost 15 per cent since the start of the year thanks to bets on rising oil and European carbon prices.

Emphasis mine there. Just to underscore that is one exceptional PR team he's got, amirite?

3. U.S. senators introduce bipartisan oil and gas leasing reform bill

Again, this attempt to increase royalty rates to 18.75% from 12.5% will likely end up in the Supreme Court. "Government taking" and what-not.

4. U.S. interior advances plan to rewrite rules regarding oil, gas extraction

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

March 10, 2021WTI up 0.9% to $64.60, nat gas down 1.4% to $2.62. Broader market futures flat.

Cale

March 10, 2021WTI up 0.9% to $64.60, nat gas down 1.4% to $2.62. Broader market futures flat.

Street consensus for WTI prices now looks like this:

2021E: $53.82

2022E: $57.00

And for nat gas:

2021E: $2.84

2022E: $2.64

Commence head-scratching as you see fit. And would note that expected '22 number for nat gas in particular seems out of whack - if for no other reason than cuz of EIA's target of $3.14 as noted yesterday.

Stay tuned. In the interim, expecting to see all of those walked higher in the coming months.

OPEC monthly report out tomorrow, too.

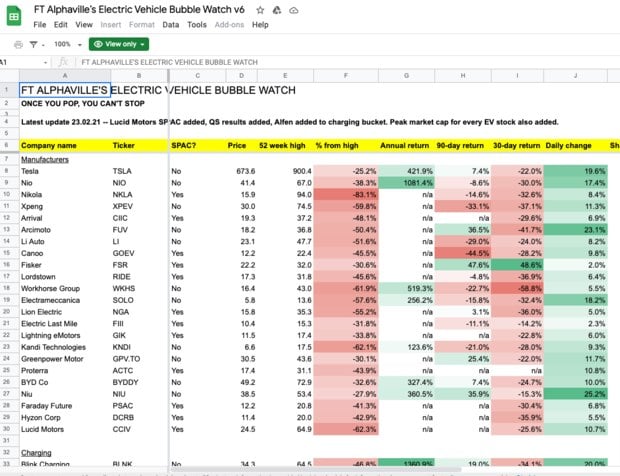

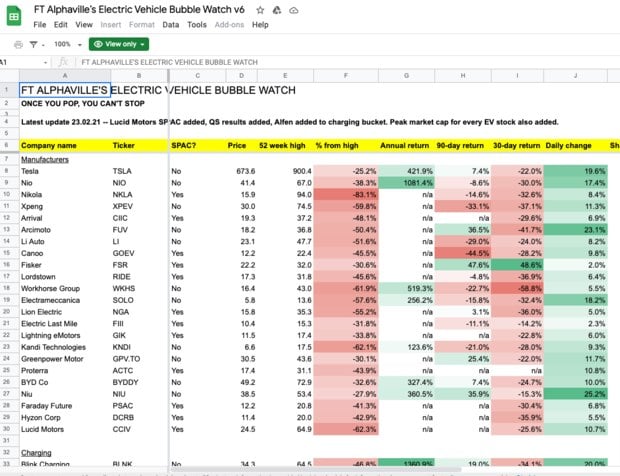

Today's Sign EVs Are A Bubble

Presenting FT Alphaville’s Electric Vehicle Bubble Watch spreadsheet.

"Once you pop, you can't stop."

It's like a Greatest Hits Album:

Brilliant. My work here is done.

Wednesday assorted links

1. What’s the deal with carbon pricing?

But there is another, simpler reason for Big Oil’s support: it is good business. The board members and executives have a fiduciary duty to their shareholders. In the long run—say, years down the line—carbon pricing may not help them, and it’s possible that carbon pricing would not result in decreased regulation. However, Big Oil has realized that the market today wants to see good immediate financials and pro-environment policies. To help their own stock prices in the immediate future, Big Oil knows that the best move is to support policies like carbon pricing. Investors seem to want environmentalist oil companies, especially if they are profitable too.

2. Yet another 'supercycle' sighting:

3. WSJ: NFTs Explained: What’s Driving Prices for LeBron James and Kings of Leon Digital Collectibles

Guy at the end nails it:

There are people who have been conditioned by cryptocurrencies to believe that just the fact that it can be owned makes it valuable. People just 100% believe that this thing has value, but in fact it doesn’t because there’s no way to get value out of it except for selling it to another investor.

Shifting gears for an early Q4 call in our group. Notes on the private boards to follow.

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services. -

Cale

March 9, 2021WTI up 0.26% to $65.22, nat gas down 0.75% to $2.64.

Cale

March 9, 2021WTI up 0.26% to $65.22, nat gas down 0.75% to $2.64.

Broad market futures higher as the bond selloff has paused. Or is over. Either way, it's probably cuz traders have discovered the ability make money trading video clips of Lebron now or something? I dunno, will ask an intern to explain NFTs to me later. Using only emojis.

Three more Q4 reports from our companies this week. First one teed up for later this morning. Call notes to follow on the private boards.

Also expecting oil to slow its roll a bit here. So, still sitting on that cash in Tarpon. No rush.

Tuesday assorted links

1. A Canadian energy fund manager on the case for energy stocks. Hat tip to Lance for the link.

2. U.S. 'alarmed' by frequency of attacks on Saudi after Houthis target oil heartland

3. “Drill, baby, drill is gone forever.”

4. Cost of Carbon Pollution Pegged at $51 a Ton

The move dramatically raises the value of carbon, which had fallen to as little as $1 under President Trump. The figure used by Biden mirrors estimates from the Obama-era, when it was $50 a ton. And it stands to go higher in January after the administration completes a comprehensive overhaul of carbon’s value.

5. EV rollout will require huge investments in strained U.S. power grids

Disclaimer: This post nor any of the material linked to herein in any way constitutes investment advice. Investing may cause capital loss. The publication of this note is in no way a solicitation or offer to sell securities or investment advisory services.

Active Discussions

-

Such an Exciting and Opportunity-Filled Time to be an Infrastructure Investor JRo,

-

United Rentals Acquiring H&E Equipment Services in ALL CASH Deal JRo,

-

"Generational" Growth Opportunity for Infrastructure According to Goldman Sachs JRo,

-

“$2 trillion in hyperscaler cloud capex could be deployed in the next five years” JRo,

-

Excellent letter from Samantha McLemore (Bill Miller’s #2 for 20 years) Cale,

- Terms of Service

- Useful Hints and Tips

- Sign In

- © 2025 Spoke Fund® Boards